Published on 6 Oct 2023 on Zacks via Yahoo Finance

Here's Why Roper (ROP) Deserves a Place in Your Portfolio

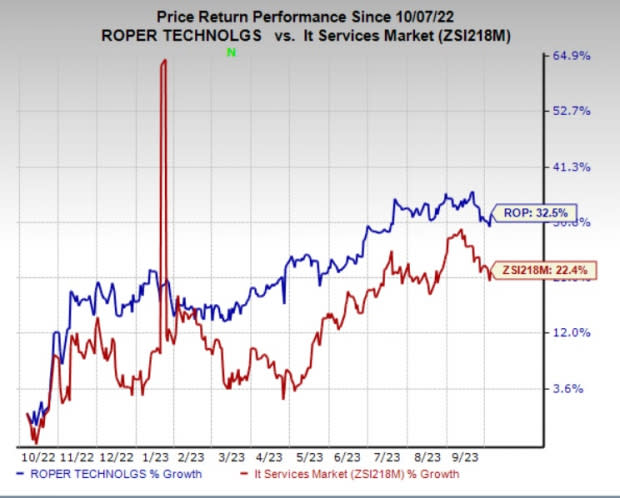

Roper Technologies ROP is benefiting from strength in the Application Software unit and accretive acquisitions. The company’s efforts to reward its shareholders through dividend payments are encouraging.Let’s delve deeper to unearth the factors that make investing in this Zacks Rank #2 (Buy) stock a smart choice now.Business Strength: Roper’s Application Software segment is benefiting from strength across its Deltek, Vertafore and Aderant businesses. Robust SaaS offerings and high retention rates are aiding Deltek. The acquisition of Replicon, expected to be completed in the third quarter of 2023, will bolster Deltek’s growth by boosting its SaaS solutions portfolio. The buyout is expected to contribute $70 million to revenues and $24 million to EBITDA in 2024. Record bookings and growing adoption and cross-selling of SaaS solutions are key catalysts to Aderant’s growth. The MGA systems acquisition and strength across the Clinisys, Data Innovations and Strata businesses are fueling growth of Vertafore. Roper expects organic revenues to increase in mid-single digits for the Application Software segment in the second half of 2023.Strong retention and customer expansion activity and strength across the Foundry business are fostering growth of the Network Software segment. Roper expects mid-single-digit organic revenue growth for the segment in the second half of 2023. Improving supply chains and solid performance of Neptune business due to increased demand for residential and commercial ultrasonic or static meters is fostering growth of the Tech-enabled Products segment. The solid performance of Verathon due to strength across reoccurring single-use products and bladder scan capital purchases bodes well for the segment. ROP expects high-single-digit organic growth for the segment in the second half of 2023.Bullish Guidance: Roper’s bullish guidance for 2023 raises optimism in the stock. For 2023, the company expects total revenues to increase around 13% year over year. Organic revenues are estimated to increase 7%. Adjusted earnings are predicted to be $16.36-$16.50 per share compared with $16.10-$16.30 expected earlier. For the third quarter, the company forecasts adjusted earnings of $4.16-$4.20 per share.Expansion Initiatives: Roper is carrying out successive acquisitions to expand its operations. In August, the company acquired cloud-based performance management and data solutions provider, Syntellis Performance Solutions, for $1.25 billion. Syntellis is expected to contribute approximately $185 million and $85 million to Roper’s revenues and EBITDA in 2024, including planned cost synergies.In October, Roper acquired Frontline Education for $3.7 billion. The acquisition boosted ROP’s Horizon software business (which it acquired in 2008), expanding its presence in the K-12 education market. The acquisition is expected to contribute approximately $370 million to Roper’s revenues and $175 million to its EBITDA in 2023. Acquisitions boosted ROP’s sales by 8% in the second quarter.Rewards to Shareholders: Strong cash flow generation capacity supports Roper’s shareholder-friendly activities. In the second quarter of 2023, the company generated a free cash flow of $295 million, up 17% year over year. In the first six months of 2023, ROP rewarded its shareholders with a dividend payment of $144.8 million, up 10.8% year over year. In November 2022, the company hiked its dividend by 10%.Price Performance: Owing to the abovementioned positives, shares of Roper have gained 32.5% in a year, outperforming the industry’s 22.4% increase.

Story continues