Published on 3 Apr 2024 on Zacks via Yahoo Finance

AllianceBernstein (AB) and Societe Generale (SCGLY) Form a JV

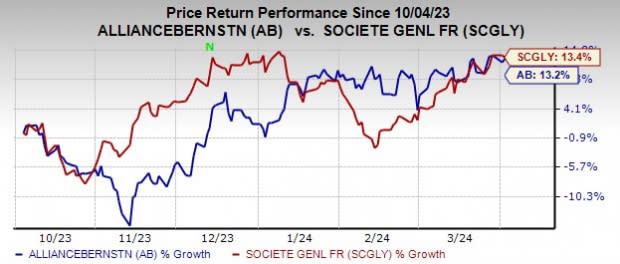

AllianceBernstein Holding L.P. AB and Societe Generale SCGLY have unveiled Bernstein, a joint venture (JV) poised to redefine the landscape of global cash equities and equity research. The plan to form Bernstein was announced in November 2022.The JV combines the strengths of both AllianceBernstein and Societe Generale. It offers institutional investors, corporates and financial institutions comprehensive insights and unparalleled access to equity markets across North America, Europe and the Asia Pacific. The JV also provides unparalleled liquidity access and leading global trading technology.Bernstein operates through more than 750 dedicated employees located in strategic global hubs in New York, London, Paris and Hong Kong. This reflects the JV’s commitment to serving diverse international clients. The JV has been formed under two separate legal vehicles — a Head Office in New York covering North America and a Head Office in London covering Europe and Asia.SCGLY's goal is to assume full ownership of the JV within five years, contingent on regulatory approvals. This underscores its long-term commitment to Bernstein's success.Robert van Brugge, the CEO of Bernstein Research, is now the CEO of the JV for an initial period of five years. Stephane Loiseau, the head of Societe Generale’s cash equities business, will be the deputy CEO.The JV capitalizes on a synergistic blend of AB's research acumen and SCGLY's extensive equities and derivatives expertise. It is a strategic move toward offering a holistic suite of services that cater to the evolving needs of global investors.Slawomir Krupa, the CEO of Societe Generale, said, “This joint venture illustrates Societe Generale's capability to develop innovative pathways to further expand our client offering as we increase our value proposition for the benefit of our investor and issuer clients, leverage synergies within our Group, and grow our revenues sustainably.”The clients of both companies stand to gain from a broader, more integrated range of financial services and insights delivered with the precision and excellence synonymous with the Bernstein name. The JV shows how strategic alliances can foster innovation, enhance global market access and deliver sustainable growth.Over the past six months, shares of AB have risen 13.2%, and the SCGLY stock has rallied 13.4%.

Story continues