Published on 21 May 2024 on Zacks via Yahoo Finance

Goldman (GS) Plans to Expand Private Equity Credit Lines

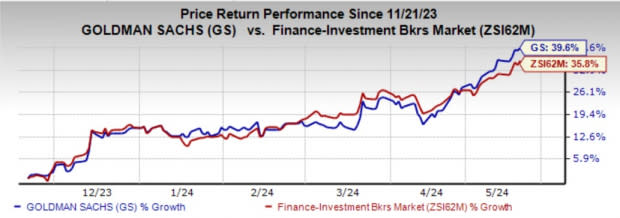

The Goldman Sachs Group, Inc. GS plans to ramp up its lending services to private equity and asset managers, per Reuters. The bank also intends to expand internationally, filling the gaps created by the problems at regional banks and the recent sale of Credit Suisse.The private equity market has a strong potential to grow as private equity deals are expected to rise, driven by record-high fundraising. These loans are classified as short-term, typically secured by the assets of the borrowing firms and hence have a lesser risk attached to them. Hence, GS’ focus on the private equity market is a strategic fit.Asset-secured lending will allow GS to expand its financing business in fixed income, currency and commodities (FICC) and equities space. The move is in line with the company’s key focus on enhancing the stability of revenue generation in its global banking and markets divisions.In the past to seven years, Goldman's deposit base experienced tremendous growth. The bank is actively seeking to align its asset growth with this expansion.In 2023, GS took over a loan portfolio worth $15 billion from the failed Signature bank. This portfolio included loans to private equity firms and venture capital funds, which is a crucial part of its client base. These loans help manage a smooth flow of working capital for the bank, also known as capital call facilities or subscription line loans. Once Goldman strengthened its operations in the United States, the bank plans to expand its lending into Europe, the U.K. and Asia. They have already added staff in its Dallas and Bangalore offices to handle these loans.Markedly, Goldman decided to refocus on its core strengths of IB and trading operations while scaling back its consumer banking footprint and hence undertook a major business restructuring initiative. In first-quarter 2024, the company completed the sale of GreenSky, its home-improvement lending platform, to a consortium of investors. In second-half 2023, it sold its Personal Financial Management unit to Creative Planning. These are in line with its decision to focus on and grow core businesses where it showcased encouraging results given its strong leadership position, wide scale of operations and exceptional talent.In the past six months, the company’s shares have rallied 39.6% compared with the industry’s growth of 35.8%.

Image Source: Zacks Investment Research