Published on 8 Jan 2024 on Zacks via Yahoo Finance

Louisiana-Pacific (LPX) Gains 31% in 3 Months: Here's Why

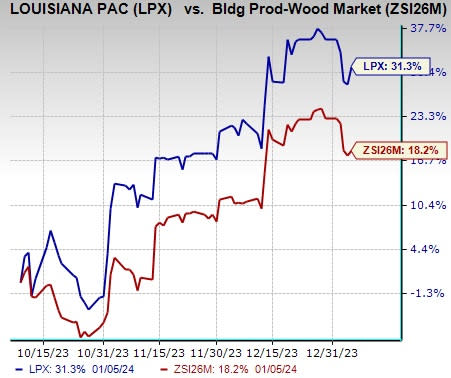

Louisiana-Pacific Corporation LPX has been gaining from the efficient execution of its business and cost-control strategies, which are reflected in the declining costs and expenses of the company, along with its investment decisions. These initiatives are aiding the growth of the company’s Siding business segment, given the sequential improvements in the housing market, especially single-family housing starts.Moreover, the housing market is currently witnessing an impressive uptrend, thanks to the recent interest rate stabilization decision by the Federal Open Market Committee (“FOMC”). Per the FOMC, the interest rate benchmark is to be maintained between 5.25% and 5.5%, with expectations of possible interest rate cuts in 2024. This macro tailwind induced a wave of relief among the housing market-related industry companies like LPX, determining prospects of growth.Thanks to these tailwinds, shares of this current Zacks Rank #3 (Hold) company grew 31.3% in the past three months, outperforming the Zacks Building Products - Wood industry’s 18.2% growth. Although the high-cost environment is restricting the growth prospects, increase in Siding sales volume and housing starts are offsetting the negative impacts to much extent.

Image Source: Zacks Investment Research