Published on 13 May 2024 on Simply Wall St. via Yahoo Finance

Topgolf Callaway Brands Corp. Beat Analyst Estimates: See What The Consensus Is Forecasting For This...

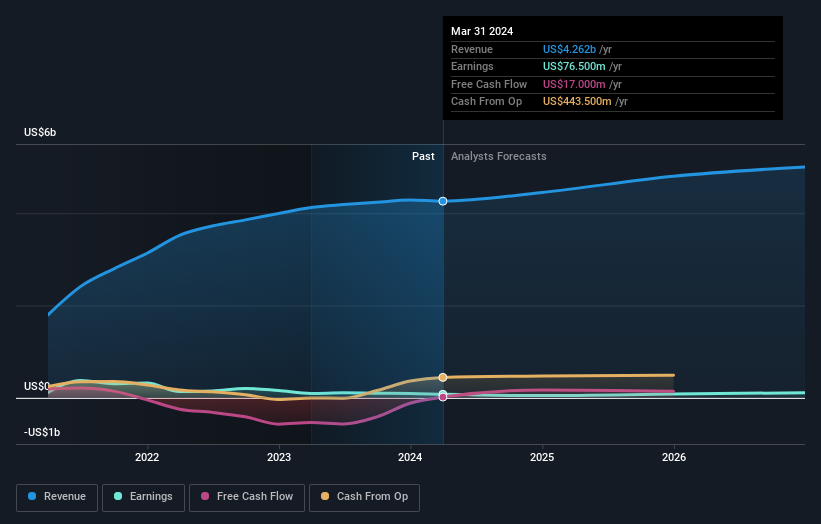

Last week, you might have seen that Topgolf Callaway Brands Corp. (NYSE:MODG) released its quarterly result to the market. The early response was not positive, with shares down 5.8% to US$15.08 in the past week. It looks like a credible result overall - although revenues of US$1.1b were what the analysts expected, Topgolf Callaway Brands surprised by delivering a (statutory) profit of US$0.04 per share, an impressive 601% above what was forecast. This is an important time for investors, as they can track a company's performance in its report, look at what experts are forecasting for next year, and see if there has been any change to expectations for the business. So we gathered the latest post-earnings forecasts to see what estimates suggest is in store for next year.

Check out our latest analysis for Topgolf Callaway Brands