Published on 29 Apr 2024 on GuruFocus.com via Yahoo Finance

Decoding Exxon Mobil Corp (XOM): A Strategic SWOT Insight

Exxon Mobil Corp's robust integrated business model showcases resilience amidst market volatility.Strategic mergers and acquisitions, including the Pioneer Natural Resources merger, bolster Exxon Mobil Corp's resource base and production capabilities.Exxon Mobil Corp faces challenges from fluctuating commodity prices and evolving climate change policies.Exxon Mobil Corp's commitment to structural cost savings and efficiency gains reflects a proactive approach to financial management.

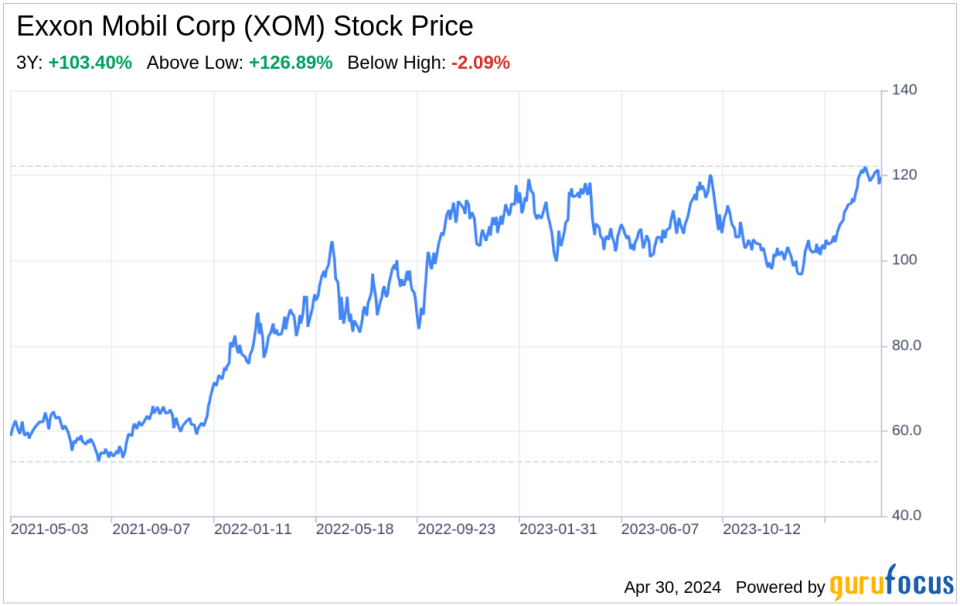

On April 29, 2024, Exxon Mobil Corp (NYSE:XOM), a leading integrated oil and gas company, filed its 10-Q report, revealing a comprehensive view of its financial health and operational performance. Despite a slight decline in sales and other operating revenue from $83,644 million in Q1 2023 to $80,411 million in Q1 2024, Exxon Mobil Corp demonstrated a strong financial foundation. The company's net income, though reduced from $11,843 million to $8,566 million year-over-year, reflects its ability to maintain profitability in a dynamic market. This SWOT analysis delves into the strengths, weaknesses, opportunities, and threats as presented in the latest SEC filing, providing investors with a nuanced understanding of Exxon Mobil Corp's strategic position.