Published on 19 Jun 2024 on Zacks · via Yahoo Finance

Vodafone (VOD) Considers Selling Tower Assets to Trim Debt Burden

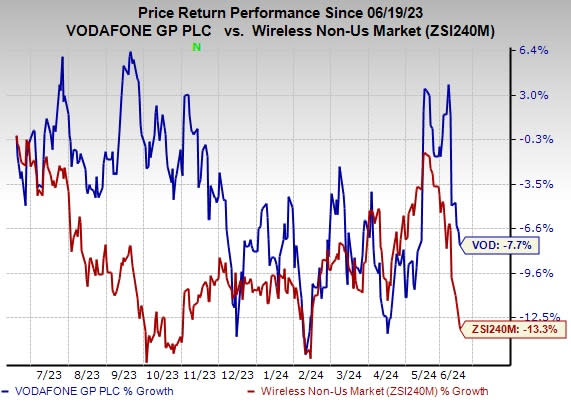

Per a Reuters report, Vodafone Group Public Limited Company VOD is mulling to divest its $2.3 billion stake in India's Indus Towers through stock market block deals next week. The strategic move is part of Vodafone’s broader effort to address its substantial debt load.The British telecom giant holds a 21.5% stake in Indus Towers via various group entities. As of the most recent closing stock price in Mumbai, this investment is valued at approximately $2.3 billion. However, the exact size of the stake sale might be less than 21.5%, depending on market demand.The transaction is crucial for Vodafone as it seeks to alleviate its massive $42.2 billion net debt.The divestiture also aligns with Vodafone's 2022 announcement to sell its then-28% stake in Indus. However, progress has been slow, with only a small portion sold until now. Efforts to sell to rival telecom firms have not been fruitful, making stock market block deals a practical alternative.Indus Towers, a major player in the global tower industry with around 220,000 towers, counts Bharti Airtel among its shareholders. From an industry perspective, block deals are gaining traction in India's bullish market, highlighted by British American Tobacco's recent $2 billion stake sale in ITC. Indus Towers, which reported a 20% increase in net profit to $221 million for the March 2024 quarter, remains an attractive asset, making this divestiture timely for both Vodafone and potential investors.The stock has lost 7.7% over the past year compared with the industry’s decline of 13.3%.

Image Source: Zacks Investment Research