Published on 6 Mar 2024 on GuruFocus.com via Yahoo Finance

Insider Sell: CFO Anuj Aggarwal Sells 20,000 Shares of Everspin Technologies Inc (MRAM)

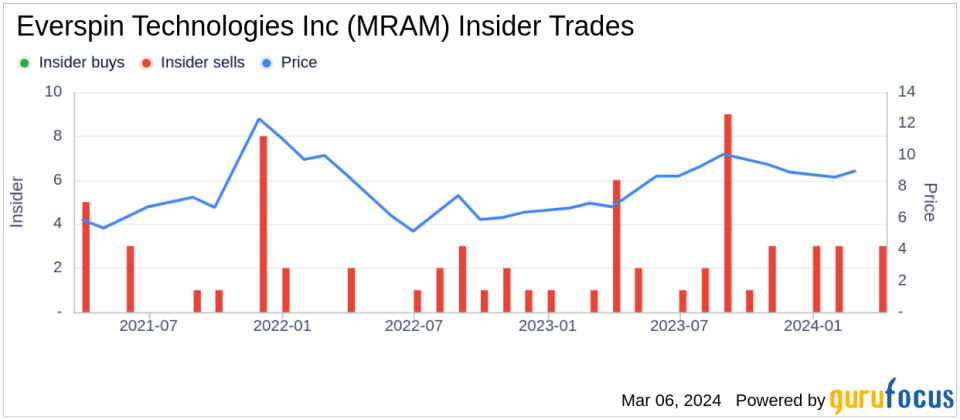

Everspin Technologies Inc (NASDAQ:MRAM), a leading provider of magnetoresistive random-access memory (NASDAQ:MRAM) solutions, has reported an insider sell according to a recent SEC filing. The company's Chief Financial Officer, Anuj Aggarwal, sold 20,000 shares of the company on March 6, 2024. The transaction was disclosed in a Form 4 filing with the Securities and Exchange Commission, which can be accessed through this SEC Filing.Over the past year, the insider has sold a total of 73,131 shares and has not made any purchases of the company's stock. This latest transaction continues a trend of insider sells at Everspin Technologies Inc, with a total of 33 insider sells and no insider buys reported over the past year.

On the day of the sale, shares of Everspin Technologies Inc were trading at $8.21, giving the company a market capitalization of $174.474 million. The stock's price-earnings ratio stands at 19.57, which is below the industry median of 29.74 and also below the company's historical median price-earnings ratio.The valuation metrics suggest that Everspin Technologies Inc is trading at a price level that is modestly overvalued when compared to its intrinsic value. The price-to-GF-Value ratio is 1.11, with the stock's price at $8.21 and the GuruFocus Value at $7.41, indicating that the stock is trading above its estimated fair value according to GuruFocus's proprietary valuation model.