Published on 19 Jun 2023 on Zacks via Yahoo Finance

Cabot (CBT) Announces Updates on Current Demand Scenario

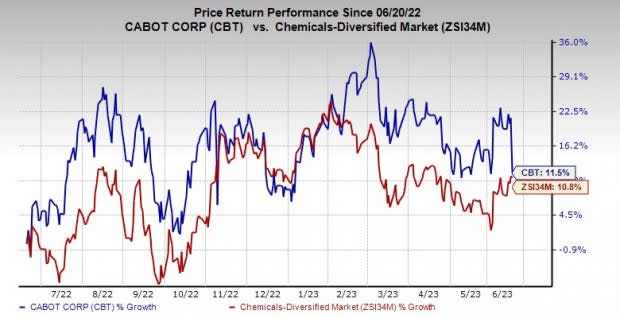

Cabot Corporation CBT recently issued an update on the impact of the current market scenario on its business segments.Sales volumes in the Performance Chemicals segment were year-over-year 13% lower in April and May 2023, with declines across all product lines except Battery Materials, where volumes climbed owing to an increase in electric car sales in China. While sales volumes in the Performance Chemicals operations are rising sequentially in the fiscal third quarter, the rate of increase is less than anticipated.Following a challenging March quarter in the Performance Chemicals division, the company is not witnessing the expected rate of recovery in China. In addition to the slowdown in China, the company continues to observe weaker demand across several of its main end industries, including construction and consumer applications, on a global basis. Given these circumstances, CBT now expects EBIT in this segment to be slightly higher in the fiscal third quarter than in the second quarter.Volumes in the Reinforcement Materials segment were down 8% year over year in April and May 2023, with declines across all regions, particularly in the replacement tire market. Despite the challenging demand climate, Cabot is experiencing the anticipated quarterly year-over-year improvement in pricing and product mix from its Reinforcement Materials customer agreements for the calendar year 2023. The company anticipates these pricing and product mix benefits will result in substantial year-over-year improvement in segment EBIT results in the third and fourth fiscal quarters.Shares of Cabot have gained 11.5% over the past year compared with a 10.8% rise of its industry.

Image Source: Zacks Investment Research