Published on 17 Nov 2023 on Zacks via Yahoo Finance

Brighthouse (BHF) Announces Buyback Authorization Worth $750M

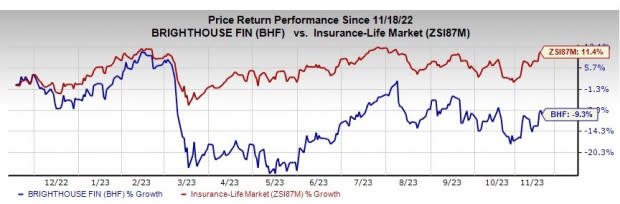

The board of directors of Brighthouse Financial, Inc. BHF recently announced the authorization to buy back up to $750 million of the company’s common shares. This program is in addition to the $1 billion stock repurchase authorization announced by BHF in August 2021, under which $71 million remains as of Nov 15, 2023.This Zacks Rank #3 (Hold) insurer intends to maintain an active and opportunistic share repurchase program and it remains committed to returning capital to shareholders over time. As of Nov 3, BHF repurchased nearly $216 million of shares, which included $64 million of shares repurchased in the third quarter of 2023.During the nine months ended Sep 30, 2023, the insurer repurchased shares through open market purchases pursuant to 10b5-1 plans for $190 million. As of Sep 30, 2023, BHF had $104 million remaining under its common stock repurchase program.Eric Steigerwalt, president and CEO of Brighthouse Financial, stated, “Since we began our common stock repurchase program in August 2018 through November 15 of this year, we have repurchased approximately $2.2 billion of our common stock and reduced the number of shares outstanding by more than 46% from the time we became an independent, public company.”Given the company’s expansive and compelling suite of life and annuity products and strong market presence, Brighthouse Financial should benefit from the growing individual insurance market. BHF remains focused on ramping up new sales of life insurance products and expanding its distribution network, aiming to become a premier player in the industry.Execution of the life insurance strategy, including the addition of new distribution partners and bringing on additional wholesalers, is expected to drive the growth. The company remains focused on transitioning the business mix to less capital-intensive products.Brighthouse Financial maintains a substantial short-term liquidity position of $3.2 billion as of Sep 30, 2023, which comprised cash and cash equivalents and short-term investments, excluding assets that are pledged or otherwise committed.The insurer boasts a strong statutory balance sheet and liquidity metrics. Its combined risk-based capital ratio was estimated between 400% and 420%. Brighthouse Financial’s liquidity position remains robust with more than $900 million of cash and liquid assets at the holding company as of Sep 30, which remained consistent with Jun 30.The insurer’s sales remained at a high level and it continues to deliver on the commitment to return capital to shareholders. BHF remains confident in its strategy and is unwavering in its focus on business growth and prudent financial management.Brighthouse Financial’s past performance depicted a robust earnings picture. Its earnings surpassed the Zacks Consensus Estimate in three of the trailing four quarters, missed once, with a surprise of 23.18%, on average.Shares of BHF have lost 9.3% over the past year against the industry’s rise of 11.4%.

Story continues