Published on 8 May 2024 on Zacks via Yahoo Finance

Revolve Group (RVLV) Q1 Earnings Beat, Sales Fall 3% Y/Y

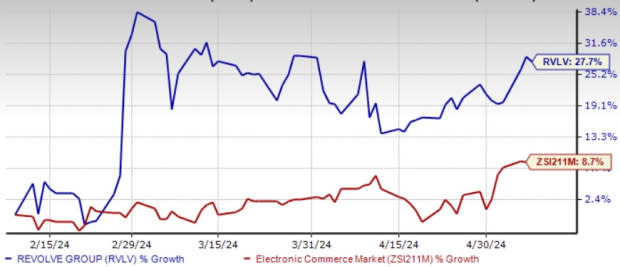

Revolve Group, Inc. RVLV came up with first-quarter 2024 results, wherein the top line missed the Zacks Consensus Estimate, while the bottom line beat the same. Both net sales and earnings experienced a year-over-year decline. Markedly, the company registered a meaningful increase in gross margin and variable logistics costs.RVLV has been strategically working on key initiatives, which in turn, is making strides in improving the foundation for profitable growth. Expanding product categories, improving service internationally, integrating AI technology, enhancing digital merchandising and investing in brand strength are few of the driving factors.This Zacks Rank #2 (Buy) stock has outperformed the industry in the past three months. Shares of the company have risen 27.7% compared with the industry’s growth of 8.7%.

Image Source: Zacks Investment Research