United Rentals (URI) to Acquire Privately Held Ahern Rentals

United Rentals, Inc. URI has signed a deal to acquire the assets of family-owned Ahern Rentals, Inc. This all-cash deal — which is valued at $2 billion — will boost capacity for United Rentals in key geographies, with concentrations on both U.S. coasts and in the Gulf region. The transaction is expected to close prior to 2022-end.

Shares of United Rentals gained 2.5% on Nov 14, 2022.

Matthew Flannery, chief executive officer of United Rentals, said, "Our acquisition of Ahern Rentals supports our strategy to deploy capital to grow the core business and drive shareholder value. We view ourselves as the ideal owner of these assets within our network, as customers will benefit from the combination of the two organizations moving forward together. We’re leveraging our competencies in larger-scale M&A to augment both our near- and long-term earnings power."

Buyout Synergies

Ahern Rentals is the eighth-largest North American equipment rental company, serving approximately 44,000 customers in the construction and industrial sectors. It operates across 106 locations in 30 states and has generated $310 million of adjusted EBITDA on $887 million of total revenue during the trailing 12 months ended Sep 30, 2022.

The combined entity will enhance the fleet available to United Rentals customers by more than 60,000 rental assets with an original cost of $1.85 billion and approximately $145 million of the non-rental fleet. Again, more than 75% of Ahern Rentals’ rental fleet is comprised of high-demand aerial and material handling equipment.

URI will be pausing its $1.25 billion share repurchase program during the early stages of its Ahern integration and expects to realize $60 million of annual revenue synergies by three years, driven by the cross-selling of its specialty rental offerings to an expanded customer base. United Rentals said the deal is expected to increase earnings per share in the first year after closing.

Share Price Performance

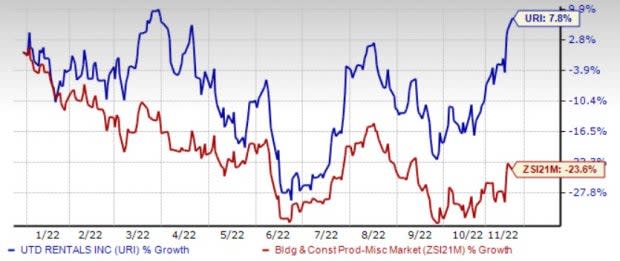

Image Source: Zacks Investment Research

URI shares have gained 7.8% year to date, outperforming the industry’s 23.6% decline. United Rentals is well-poised for growth, given constant growth opportunities for non-residential and industrial verticals. The company is benefiting from the U.S. administration’s increased focus on infrastructural improvement. Even its new upbeat 2022 guidance exhibits broad-based growth across its verticals, with continuous growth opportunities for datacenters, distribution centers and renewables as well as the automotive and ship plants projects.

The company’s third-quarter 2022 earnings and revenues grew 40.9% and 17.5% year over year, respectively. The results were driven by higher rental revenues (up 20%), fleet productivity (up 8.9%) and absorptions, mainly attributable to the broad-based recovery of activity across end markets served by the company.

The Zacks Consensus Estimate has witnessed an uptrend over the past 30 days as analysts raised their estimates. Over the said time frame, the Zacks Consensus Estimate for 2023 has increased to $36.27 from $35.16 per share. The estimated figure indicates 11.5% year-over-year growth.

Zacks Rank & Other Key Picks

United Rentals currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other top-ranked stocks, which warrant a look in the Construction sector, include EMCOR Group, Inc. EME, Sterling Infrastructure, Inc. STRL and Altair Engineering Inc. ALTR.

EMCOR — carrying a Zacks Rank #2 — is one of the leading providers of mechanical and electrical construction, industrial and energy infrastructure, as well as building services for a diverse range of businesses.

EME’s expected earnings growth rate for 2023 is 17%. The Zacks Consensus Estimate for 2023 earnings has improved to $9.10 from $8.79 over the past 30 days.

Sterling Infrastructure — carrying a Zacks Rank #2 — provides the transportation, e-infrastructure, and building solutions.

STRL’s expected earnings growth rate for 2023 is 6.3%. The Zacks Consensus Estimate for 2023 earnings has improved to $3.37 from $3.26 over the past 30 days.

Altair Engineering — holding a Zacks Rank #2 — provides software and cloud solutions in the areas of simulation, high-performance computing, data analytics, and artificial intelligence worldwide.

ALTR’s expected earnings growth rate for 2023 is 21.5%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Altair Engineering Inc. (ALTR) : Free Stock Analysis Report

EMCOR Group, Inc. (EME) : Free Stock Analysis Report

United Rentals, Inc. (URI) : Free Stock Analysis Report

Sterling Infrastructure, Inc. (STRL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research