Qudian (NYSE:QD) shareholders have endured a 86% loss from investing in the stock three years ago

Qudian Inc. (NYSE:QD) shareholders should be happy to see the share price up 12% in the last quarter. But only the myopic could ignore the astounding decline over three years. In that time the share price has melted like a snowball in the desert, down 86%. So we're relieved for long term holders to see a bit of uplift. Of course the real question is whether the business can sustain a turnaround. We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

Now let's have a look at the company's fundamentals, and see if the long term shareholder return has matched the performance of the underlying business.

View our latest analysis for Qudian

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

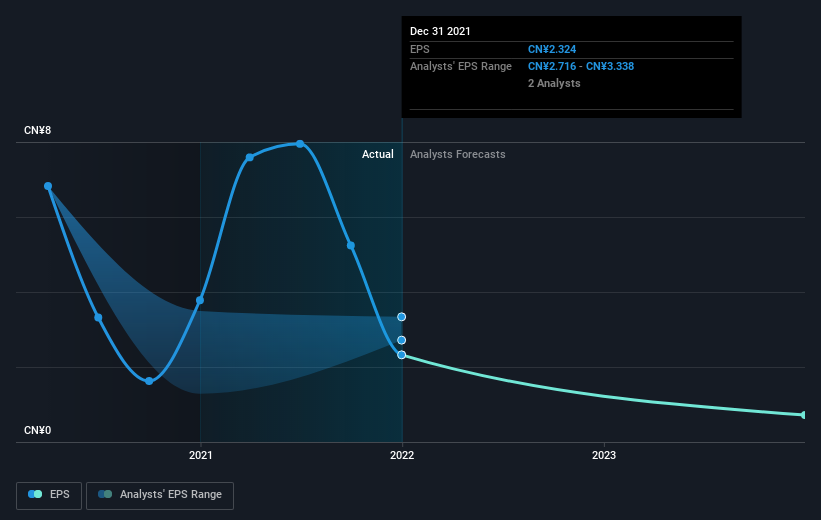

Qudian saw its EPS decline at a compound rate of 33% per year, over the last three years. This reduction in EPS is slower than the 49% annual reduction in the share price. So it seems the market was too confident about the business, in the past. The less favorable sentiment is reflected in its current P/E ratio of 3.01.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

A Different Perspective

Qudian shareholders are down 49% for the year, falling short of the market return. Meanwhile, the broader market slid about 5.6%, likely weighing on the stock. Shareholders have lost 23% per year over the last three years, so the share price drop has become steeper, over the last year; a potential symptom of as yet unsolved challenges. Although Baron Rothschild famously said to "buy when there's blood in the streets, even if the blood is your own", he also focusses on high quality stocks with solid prospects. It's always interesting to track share price performance over the longer term. But to understand Qudian better, we need to consider many other factors. Case in point: We've spotted 2 warning signs for Qudian you should be aware of, and 1 of them doesn't sit too well with us.

We will like Qudian better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.