Williams (WMB) to Report Q2 Earnings: What to Expect?

The Williams Companies, Inc. WMB is set to release second-quarter results on Aug 1. The current Zacks Consensus Estimate for the to-be-reported quarter is a profit of 37 cents per share on revenues of $3 billion.

Let’s delve into the factors that might have influenced the oil and gas pipeline operator’s performance in the June quarter. But it’s worth taking a look at Williams’ previous-quarter results first.

Highlights of Q1 Earnings & Surprise History

In the last-reported quarter, the energy infrastructure provider beat the consensus mark on higher-than-expected contribution from the key ‘Transmission’ segment. Williams had reported adjusted earnings per share of 41 cents, beating the Zacks Consensus Estimate of 36 cents. But revenues of $2.5 billion generated by the firm came 20.9% below the consensus mark due to lower-than-expected numbers in the Northeast G&P and West units.

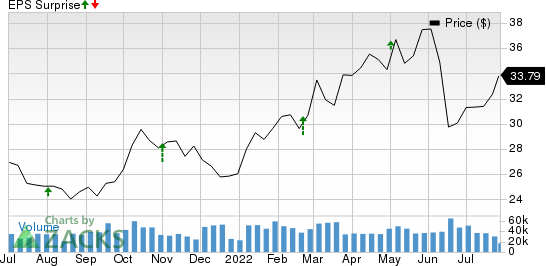

WMB topped the Zacks Consensus Estimate by an average of 15.3% in the trailing four quarters. This is depicted in the graph below:

Williams Companies, Inc. The Price and EPS Surprise

Williams Companies, Inc. The price-eps-surprise | Williams Companies, Inc. The Quote

Trend in Estimate Revision

The Zacks Consensus Estimate for the second-quarter bottom line has remained the same in the past seven days. The estimated figure indicates a 37% rise year over year. The Zacks Consensus Estimate for revenues, meanwhile, suggests a 31.8% increase from the year-ago period.

Factors to Consider

Williams’ Transmission & Gulf of Mexico segment — which includes the company’s crown jewel and the nation’s largest and fastest-growing natural gas pipeline system Transco — is expected to have generated robust profits in the second quarter. The unit is likely to have benefited from the expansion projects around Transco being placed into service over the past few years and the additional volumes from their infrastructure on the back of strong drilling activity. The Zacks Consensus Estimate for the segment’s adjusted EBITDA is pegged at $697 million for the to-be-reported quarter, up from the prior-year period’s level of $648 million.

The Northeast G&P unit — engaged in natural gas gathering and processing along with the NGL fractionation business in Marcellus and Utica shale regions — is also expected to have done well in the to-be-reported quarter. Echoing the segment’s healthy dynamics, the Zacks Consensus Estimate for the quarter’s adjusted EBITDA is projected at $456 million. The number suggests an 11.5% increase from the profit of $409 million reported in the year-ago quarter.

On a somewhat bearish note, Williams’ operating and maintenance expense in the first quarter increased more than 9% year over year to $394 million. The upward cost trajectory is likely to have continued in the June quarter due to inflationary pressures. This is expected to have somewhat dented WMB’s to-be-reported earnings.

What Does Our Model Say?

The proven Zacks model does not conclusively predict that Williams is likely to beat second-quarter estimates. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of beating estimates. But that’s not the case here.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Earnings ESP: Earnings ESP, which represents the difference between the Most Accurate Estimate and the Zacks Consensus Estimate, for this company is -0.27%.

Zacks Rank: WMB currently carries a Zacks Rank #3.

Stocks to Consider

While an earnings beat looks uncertain for WMB, here are some firms from the energy space that you may want to consider on the basis of our model:

Delek US Holdings, Inc. DK has an Earnings ESP of +18.14% and a Zacks Rank #1. The firm is scheduled to release earnings on Aug 4.

You can see the complete list of today’s Zacks #1 Rank stocks here.

For 2022, Delek US Holdings has a projected earnings growth rate of 315.2%. Valued at around $2.1 billion, DK has gained around 40.3% in a year.

Cactus, Inc. WHD has an Earnings ESP of +3.74% and a Zacks Rank #2. The firm is scheduled to release earnings on Aug 4.

Cactus topped the Zacks Consensus Estimate by an average of 4.3% in the trailing four quarters, including a 3.5% beat in Q1. WHD has edged up some 2.5% in a year.

ConocoPhillips COP has an Earnings ESP of +1.21% and a Zacks Rank #3. The firm is scheduled to release earnings on Aug 4.

For 2022, ConocoPhillips has a projected earnings growth rate of 142.9%. Valued at around $119.1 billion, COP has gained around 61.7% in a year.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Williams Companies, Inc. The (WMB) : Free Stock Analysis Report

ConocoPhillips (COP) : Free Stock Analysis Report

Delek US Holdings, Inc. (DK) : Free Stock Analysis Report

Cactus, Inc. (WHD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research