Nutrien's (NTR) Earnings and Revenues Lag Estimates in Q2

Nutrien Ltd. NTR recorded profits of $3,601 million or $6.51 per share in second-quarter 2022, up from a profit of $1,113 million or $1.94 in the year-ago quarter.

Barring one-time items, adjusted earnings per share (EPS) were $5.85. The bottom line missed the Zacks Consensus Estimate of $5.90.

Sales climbed around 49% year over year to $14,506 million in the quarter. The figure, however, missed the Zacks Consensus Estimate of $15,359.8 million. The company benefited from higher selling prices and strong Retail performance in the quarter.

Nutrien Ltd. Price, Consensus and EPS Surprise

Nutrien Ltd. price-consensus-eps-surprise-chart | Nutrien Ltd. Quote

Segment Highlights

Sales in the Nutrien Ag Solutions (Retail) segment rose 25% year over year to $9,422 million in the quarter. Sales of crop nutrients increased in the quarter on higher prices. Sales of crop protection products also increased owing to higher selling prices and increased sales in proprietary products.

Potash division’s sales surged 227% year over year to $2,668 million driven by higher net realized selling prices. Sales volumes in the segment were driven by strong demand in offshore markets. Volumes in North America were impacted by delayed planting and a compressed application window. Selling prices increased on the back of tight supply.

Sales in the Nitrogen segment were $1,880 million, up around 91% year over year. The upside can be attributed to higher net realized selling prices, which offset lower volumes. Sales volume fell due to plant outages impacting ammonia and urea production as well as cool and wet spring in North America. The company witnessed higher natural gas costs in the quarter.

Sales in the Phosphate segment were $514 million, up 46% year over year on the back of higher net realized selling price. Prices rose in sync with an increase in global benchmark prices. Volumes declined in the quarter, impacted by the cool and wet spring in North America.

Financials

At the end of the quarter, Nutrien had cash and cash equivalents of $711 million, down around 60% year over year. Long-term debt was $7,056 million, down roughly 30% year over year.

Cash provided by operating activities was $2,558 million for the reported quarter, up around 30% year over year.

The company repurchased around 22 million shares year-to-date as of Aug 2, 2022, for a total of roughly $1.8 billion.

Guidance

Nutrien revised its full-year 2022 adjusted EBITDA guidance and full-year adjusted net earnings per share guidance factoring in lower expected Nitrogen earnings due to reduced nitrogen benchmark pricing and higher natural gas costs.

The company now expects adjusted EBITDA of $14-$15.5 billion (down from $14.5-$16.5 billion) for full-year 2022. Adjusted EPS has been forecast in the band of $15.80-$17.80 (down from $16.20-$18.70). Nutrien also sees sustaining capital expenditure of $1.3-$1.4 billion in 2022.

The company also now sees potash sales volumes of between 14.3 million and 14.9 million tons in 2022. Nitrogen sales volumes are now projected in the band of 10.6-11 million tons for the year.

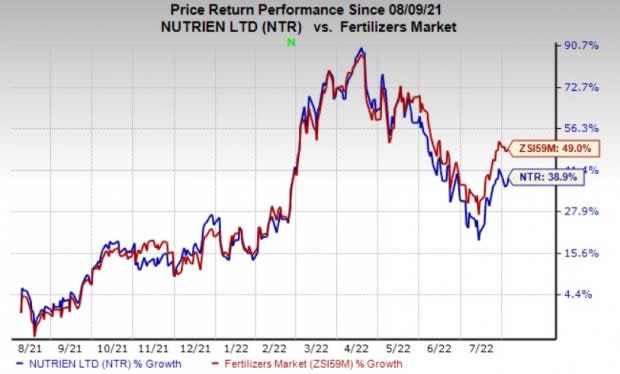

Price Performance

Nutrien’s shares have gained 38.9% in the past year compared with 49% rise of the industry.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Nutrien currently carries a Zacks Rank #2 (Buy).

Other top-ranked stocks worth considering in the basic materials space include Cabot Corporation CBT, Sociedad Quimica y Minera de Chile S.A. SQM and Albemarle Corporation ALB.

Cabot, currently carrying a Zacks Rank #1 (Strong Buy), has an expected earnings growth rate of 22.5% for the current fiscal year. The Zacks Consensus Estimate for CBT's earnings for the current fiscal has been revised 0.8% upward in the past 60 days. You can see the complete list of today’s Zacks #1 Rank stocks here.

Cabot’s earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, the average being 16.2%. CBT has gained around 34% over a year.

Sociedad has a projected earnings growth rate of 513.7% for the current year. The Zacks Consensus Estimate for SQM’s current-year earnings has been revised 57.8% upward in the past 60 days.

Sociedad’s earnings beat the Zacks Consensus Estimate in two of the trailing four quarters, the average being 28.2%. SQM has gained roughly 82% in a year. The company sports a Zacks Rank #1.

Albemarle has a projected earnings growth rate of 231.4% for the current year. The Zacks Consensus Estimate for ALB's current-year earnings has been revised 3.6% upward in the past 60 days.

Albemarle’s earnings beat the Zacks Consensus Estimate in each of the last four quarters. It has a trailing four-quarter earnings surprise of roughly 24.2%, on average. ALB has gained around 3% in a year and currently carries a Zacks Rank #2.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Albemarle Corporation (ALB) : Free Stock Analysis Report

Sociedad Quimica y Minera S.A. (SQM) : Free Stock Analysis Report

Cabot Corporation (CBT) : Free Stock Analysis Report

Nutrien Ltd. (NTR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research