Defense Wins Ballgames; 3 Stocks That Will Bulletproof a Portfolio

It’s no secret that 2022 has been rough sailing in the market. Supply chain bottlenecks, soaring energy prices, geopolitical issues, and a hawkish Fed have turned investors’ sentiment sour, slashing the valuations of many companies.

When sailing through rough waters, investors must blend a higher level of defense into their portfolios to prevent their ships from taking on water. Believe it or not, there have been plenty of stocks throughout 2022 that have yielded investors considerable gains while easily outpacing the general market.

Generally, companies that perform well during drawdowns aren’t the exciting, high-flying technology companies that investors clamor over. But what is exciting is the fact that it’s still possible to find prosperity in dark times by parking your hard-earned cash in companies that have proven their ability to generate gains in adverse market conditions.

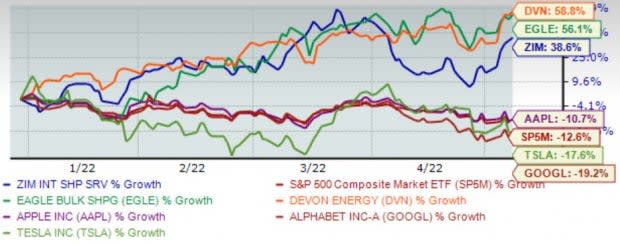

The three companies we will discuss – ZIM Integrated Shipping Services ZIM, Eagle Bulk Shipping EGLE, and Devon Energy Corporation DVN – have all easily outpaced the general market and investors’ favorites such as Tesla TSLA, Alphabet GOOGL, and Apple AAPL throughout 2022.

These stocks all carry a highly-coveted Zacks Rank #1 (Strong Buy) or a Zacks Rank #2 (Buy); the Zacks Rank is an absolute top-tier way investors can find real winners in the market. Simply put, it’s one of the most powerful market tools out there.

We can see how powerful the Zacks Rank is by creating a chart that shows the year-to-date performance of all three companies vs. the S&P 500 and the widley-known companies mentioned above (TSLA, AAPL, GOOGL).

Image Source: Zacks Investment Research

Quite the difference there, isn’t it? On top of the robust share performance, all three companies have respectable dividend yields higher than 5%. Let’s get into why these companies are a tremendous defensive bet.

Devon Energy

Devon Energy Corporation DVN is an independent energy company primarily engaged in exploring, developing, and producing oil and natural gas. The company’s operations are mainly concentrated in the onshore areas of North America.

DVN thoroughly enjoys rewarding its shareholders; its dividend metrics are robust. The company’s dividend yield sits at 5.9%, with a very sustainable payout ratio of 13% of earnings. What sticks out to me is its dividend growth – the company has increased its dividend a whopping ten times in the past five years, giving it a five-year annualized dividend growth rate of nearly 32%.

Valuation metrics look great as well. Its current forward P/E ratio of 7.9X is nearly half its 2021 high of 14.6X. Additionally, the forward-earnings multiple currently represents a deep discount of 57% relative to the S&P 500’s value.

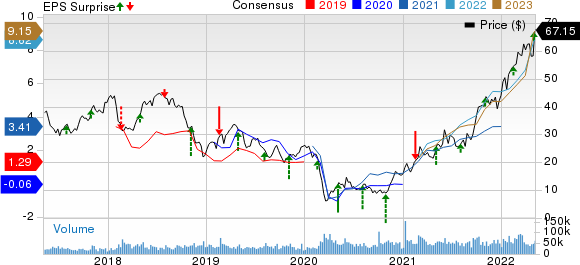

The company’s next quarterly release is looking very strong. Over the last 60 days, the Consensus Estimate Trend for the quarter has increased 42% up to $2.22 per share, boosted by eight positive estimate revisions from analysts. Additionally, there have been zero negative estimate revisions over this period. The quarterly estimate reflects an enormous growth in earnings of 270% from the year-ago quarter.

DVN is currently a Zacks Rank #1 (Strong Buy) with an overall VGM Score of a B.

Devon Energy Corporation Price, Consensus and EPS Surprise

Devon Energy Corporation price-consensus-eps-surprise-chart | Devon Energy Corporation Quote

ZIM Integrated Shipping Services

ZIM Integrated Shipping Services ZIM provides customers with innovative seaborne transportation and logistics services covering the world’s major trade routes, focusing on select markets with competitive advantages that allow the company to maximize its market position.

ZIM has a stellar dividend yield of 29.7%, with a sustainable payout ratio at 26% of earnings. The company went public in January of 2021 and has since increased its dividend twice.

The real surge in the dividend yield occurred on March 9th when the company announced that shareholders on record as of March 22, 2022 would receive a dividend of $17 per share, much higher than the previous $2.50 per share dividend. Clearly, ZIM is dedicated to rewarding its shareholders.

ZIM has very sound valuation metrics; its current forward-earnings multiple of 1.8X screams undervalued and is well under its May 2021 high of 4.8X. In fact, the value represents a staggering 90% discount relative to the S&P 500’s forward P/E of 18.5X.

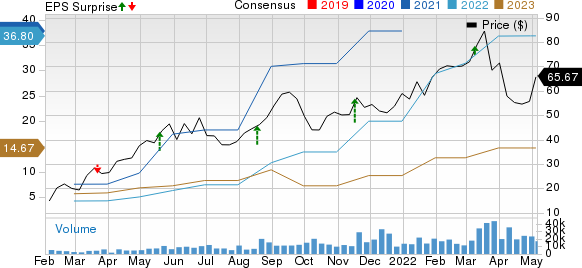

For the upcoming quarterly release, the Zacks Consensus Estimate trend has increased marginally up to $12.65 per share over the last 60 days, reflecting a massive growth in earnings of nearly 150% from the year-ago quarter.

ZIM is a Zacks Rank #2 (Buy) with an overall VGM Score of an A.

ZIM Integrated Shipping Services Ltd. Price, Consensus and EPS Surprise

ZIM Integrated Shipping Services Ltd. price-consensus-eps-surprise-chart | ZIM Integrated Shipping Services Ltd. Quote

Eagle Bulk Shipping

Eagle Bulk Shipping Inc. EGLE is a fully integrated shipowner-operator engaged in global transportation, focusing exclusively on the mid-size dry bulk vessel segment. It owns one of the largest fleets of Supramax/Ultramax ships globally.

EGLE’s dividend yield also sits in the double-digits at 12.2%, with a payout ratio on the higher side at 63% of earnings. Additionally, the company has increased its dividend twice over the last five years, although it recently started its dividend payments in 2021.

EGLE’s current forward-earnings multiple sits at a very respectable 4.1X, a fraction of its 10.3X high in May 2021 and just above its lows of 3.1X earlier this year in January. Additionally, the forward earnings multiple reflects a considerable 78% discount relative to the S&P 500.

For the quarterly report coming in August, the consensus estimate trend has climbed a notable 11%, boosted by two positive estimate revisions from analysts. The quarterly estimate reflects a sizable 40% growth in earnings from the previous quarter.

EGLE is a Zacks Rank #2 (Buy) with an overall VGM Score of an A.

Eagle Bulk Shipping Inc. Price, Consensus and EPS Surprise

Eagle Bulk Shipping Inc. price-consensus-eps-surprise-chart | Eagle Bulk Shipping Inc. Quote

Bottom Line

Investors must stack a layer of defense into their portfolios to limit drawdowns from the broader market. All three of these stocks have shown immense relative strength over 2022, increasing considerably in valuation.

Sometimes, it’s difficult not to get caught up in all the high-flying tech stocks; they’re exciting, fun, and innovative investments to park cash. However, the market is much broader than just tech and high-growth companies. By utilizing the Zacks Rank, we can find these winners quite easily.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Apple Inc. (AAPL) : Free Stock Analysis Report

Devon Energy Corporation (DVN) : Free Stock Analysis Report

Tesla, Inc. (TSLA) : Free Stock Analysis Report

Eagle Bulk Shipping Inc. (EGLE) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

ZIM Integrated Shipping Services Ltd. (ZIM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research