Is KeyCorp (KEY) Worth a Watch for 7.1% Dividend Yield?

Solid dividend-yielding stocks are highly desirable amid uncertain economic conditions in the near term. One such stock from the banking industry is KeyCorp KEY.

Headquartered in Cleveland, OH, KEY provides wide range of financial products and services, operating in a widespread network of more than 956 branches. The bank has been increasing its quarterly dividend on a regular basis, with the last hike of 5.1% to 20.5 cents per share in November 2022.

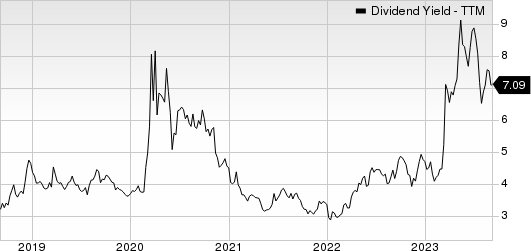

Over the past five years, KeyCorp raised its dividend three times, with an annualized dividend growth rate of 3.9%. Considering the last day’s closing price of $11.56, the company’s dividend yield currently stands at 7.09%. This is impressive compared with the industry’s average of 4.21% and attractive for investors as it represents a steady income stream.

KeyCorp Dividend Yield (TTM)

KeyCorp dividend-yield-ttm | KeyCorp Quote

Is KeyCorp stock worth keeping an eye to earn a high dividend yield? Let’s check the company's financials to understand the risks and rewards.

KeyCorp has been witnessing solid organic growth over the past several years. Though tax-equivalent revenues declined in 2019 and 2022, the metric witnessed a compound annual growth rate (CAGR) of 3.1% over the last five years (2017-2022).

The momentum continued in the first six months of 2023 as well. The rise was mainly driven by higher loan balances. During the four-year period ended 2022, loans and deposits witnessed a CAGR of 7.5% and 7.4%, respectively.

Supported by modest loan demand and efforts to strengthen fee income, its top line is expected to keep improving. Though we project total revenues to decline 11.7% this year, it will rebound and grow 2.7% and 6.2% in 2024 and 2025, respectively.

With Federal Reserve expected to keep interest rates high in the near term, KeyCorp’s net interest margin (NIM) is likely to continue growing in the near term (though the pace of growth will slow down on higher funding costs). We suggest NIM to be 2.22%, 2.18% and 2.20% in 2023, 2024 and 2025, respectively.

KeyCorp’s inorganic expansion efforts are impressive. Last year, the company acquired GradFin, which strengthened its digital offering capabilities. In 2021, it acquired a B2B-focused digital platform, XUP Payments, and a data analytics-driven consultancy firm, AQN Strategies LLC.

These, along with several past buyouts/expansion initiatives, are expected to strengthen its product suites and market share as well as help diversify revenues. This will help driving fee income growth going forward. Though we forecast total non-interest income to decline 8.4% this year, it will bounce back and rise 7.1% and 6.4% in 2024 and 2025, respectively.

Despite near-term headwinds including rising expenses, substantial exposure to commercial loans and weak asset quality on the back of worsening macroeconomic outlook, KEY is fundamentally solid. In the past six months, shares of this Zacks Rank #3 (Hold) company have plunged 36% compared with the industry’s decline of 11.5%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Image Source: Zacks Investment Research

Therefore, investors should keep this stock on their radar as this will help generate robust returns over time.

Bank Stocks With Solid Dividends

Banking stocks like Premier Financial PFC and Fifth Third Bancorp FITB are worth a look as these too have decent dividend yields.

Considering the last day’s closing price, Premier Financial’s dividend yield currently stands at 6.4%. In the past three months, shares of PFC have increased 19.8%.

Based on the last day’s closing price, Fifth Third’s dividend yield currently stands at 4.88%. In the past three months, shares of FITB have gained 1%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Fifth Third Bancorp (FITB) : Free Stock Analysis Report

KeyCorp (KEY) : Free Stock Analysis Report

Premier Financial Corp. (PFC) : Free Stock Analysis Report