Transocean (RIG) Secures Contract Extension, Shares Jump

Shares of Vernier, Switzerland-based American offshore driller, Transocean Ltd. RIG, surged 13.7% yesterday after stating that a unit of the energy major, Equinor ASA, has awarded a surplus of nine wells plus two, one-well options to the contract for harsh environment semisubmersible Transocean Spitsbergen for its work in offshore Norway.

With a projected backlog of $181 million, the major part of the contract extension is anticipated to commence in October 2023 and finish by April 2025.

The estimated firm backlog does not include revenues related to performance incentives, additional services and option periods given as part of the contract.

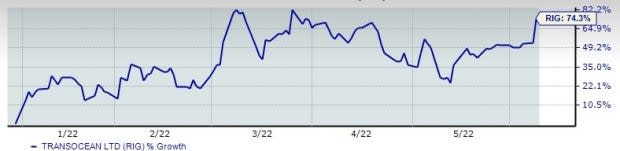

Transocean, which reported a first-quarter adjusted loss of 28 cents per share on revenues of $615 million last month, has experienced a 74.6% year-to-date stock price rise. However, during the past year, RIG stock has rallied just 16.2%.

Image Source: Zacks Investment Research

Transocean is the world’s largest offshore drilling contractor and a leading provider of drilling management services. The company provides rigs on a contractual basis to explore and develop oil and gas. Transocean offers offshore drilling rigs, equipment, services and manpower (with a particular emphasis on ultra-deepwater and harsh environment drilling services) to exploration and production companies worldwide.

Transocean currently has a Zacks Rank #3 (Hold). Those interested in the energy sector might want to look at some better-ranked stocks. Oasis Petroleum OAS, ConocoPhillips COP and Marathon Petroleum MPC each sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Oasis Petroleum’s stock has increased 113.1% in a year. Oasis Petroleum beat the Zacks Consensus Estimate for earnings in three of the trailing four quarters, the average being around 19.6%.

The Zacks Consensus Estimate for OAS’ 2022 earnings is projected at $39.76 per share, up about 317.6% from the projected year-ago earnings of $9.52.

ConocoPhillips is valued at around $158.7 billion. The consensus estimate for ConocoPhillips’ 2022 earnings has been revised 39.8% upward over the past 60 days.

COP beat the Zacks Consensus Estimate for earnings in each of the trailing four quarters, the average being 7.6%. ConocoPhillips has gone up 111.7% in a year.

Marathon Petroleum is valued at around 61.4 billion. Marathon Petroleum beat the Zacks Consensus Estimate for earnings in all the trailing four quarters, the average being around 65%.

The Zacks Consensus Estimate for MPC’s 2022 earnings is projected at $11.03 per share, up approximately 350% from the projected year-ago earnings of $2.45.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Transocean Ltd. (RIG) : Free Stock Analysis Report

ConocoPhillips (COP) : Free Stock Analysis Report

Marathon Petroleum Corporation (MPC) : Free Stock Analysis Report

Oasis Petroleum Inc. (OAS) : Free Stock Analysis Report

To read this article on Zacks.com click here.