ETF Flows Hold Steady as Markets Rebound in January

Investors piled $47 billion into U.S. ETFs as global stocks and bonds rallied.

Key Takeaways

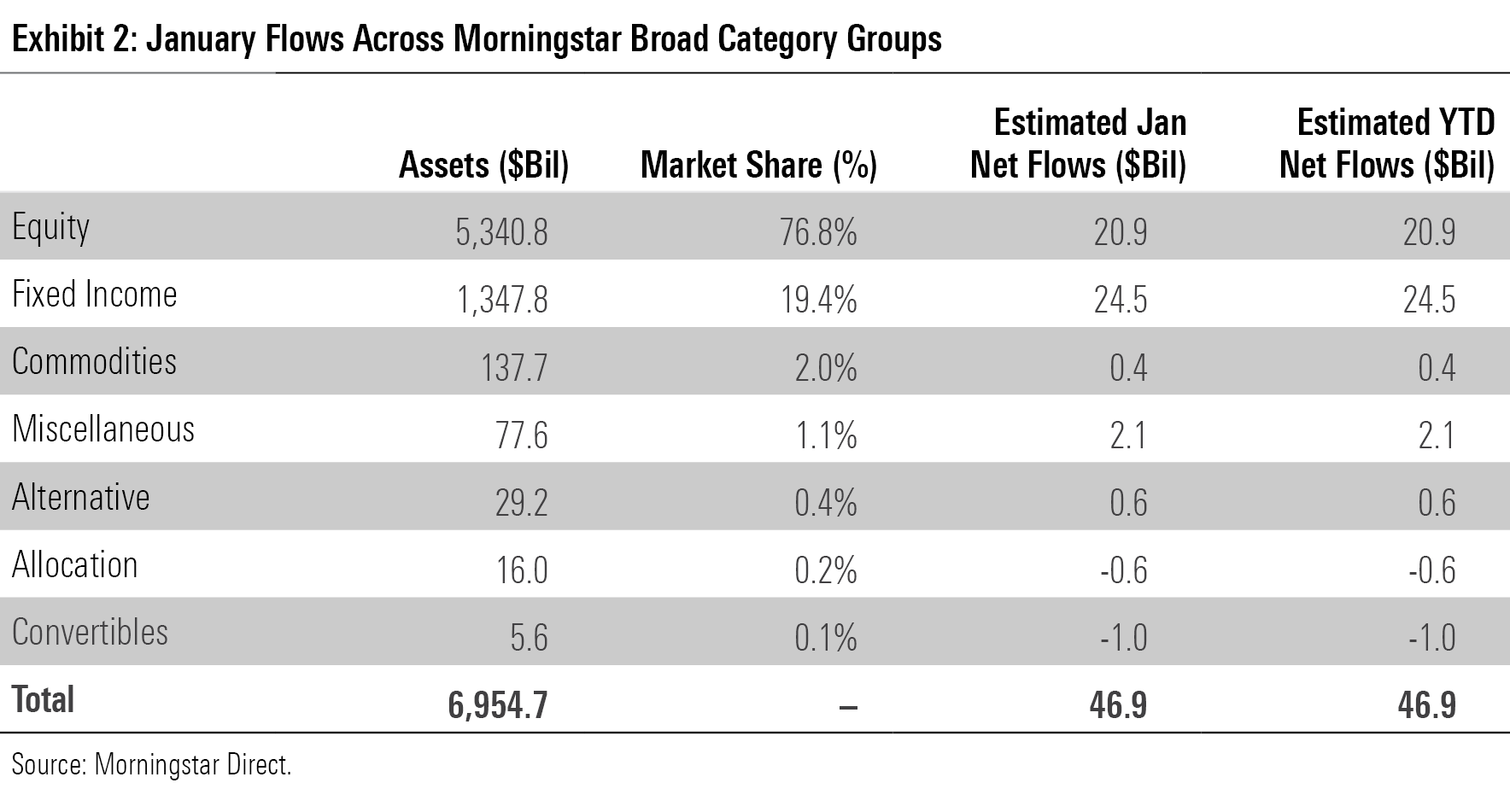

- U.S. exchange-traded funds reeled in an estimated $47 billion in January 2023, roughly on par with their average monthly inflow in 2022.

- Bond ETFs’ $24.4 billion of inflows represented stronger organic and absolute growth than the $20.9 billion that stock ETFs collected.

- The Morningstar Global Markets Index climbed 7.18% as international and domestic equities rallied.

- Growth stocks trounced value stocks after their cheaper counterparts held up much better in 2022.

- Investors flooded international stock funds, leaving U.S. stock funds with their weakest inflows since April 2022.

- Treasury ETFs remained in vogue; corporate-bond ETFs drummed up healthy investment.

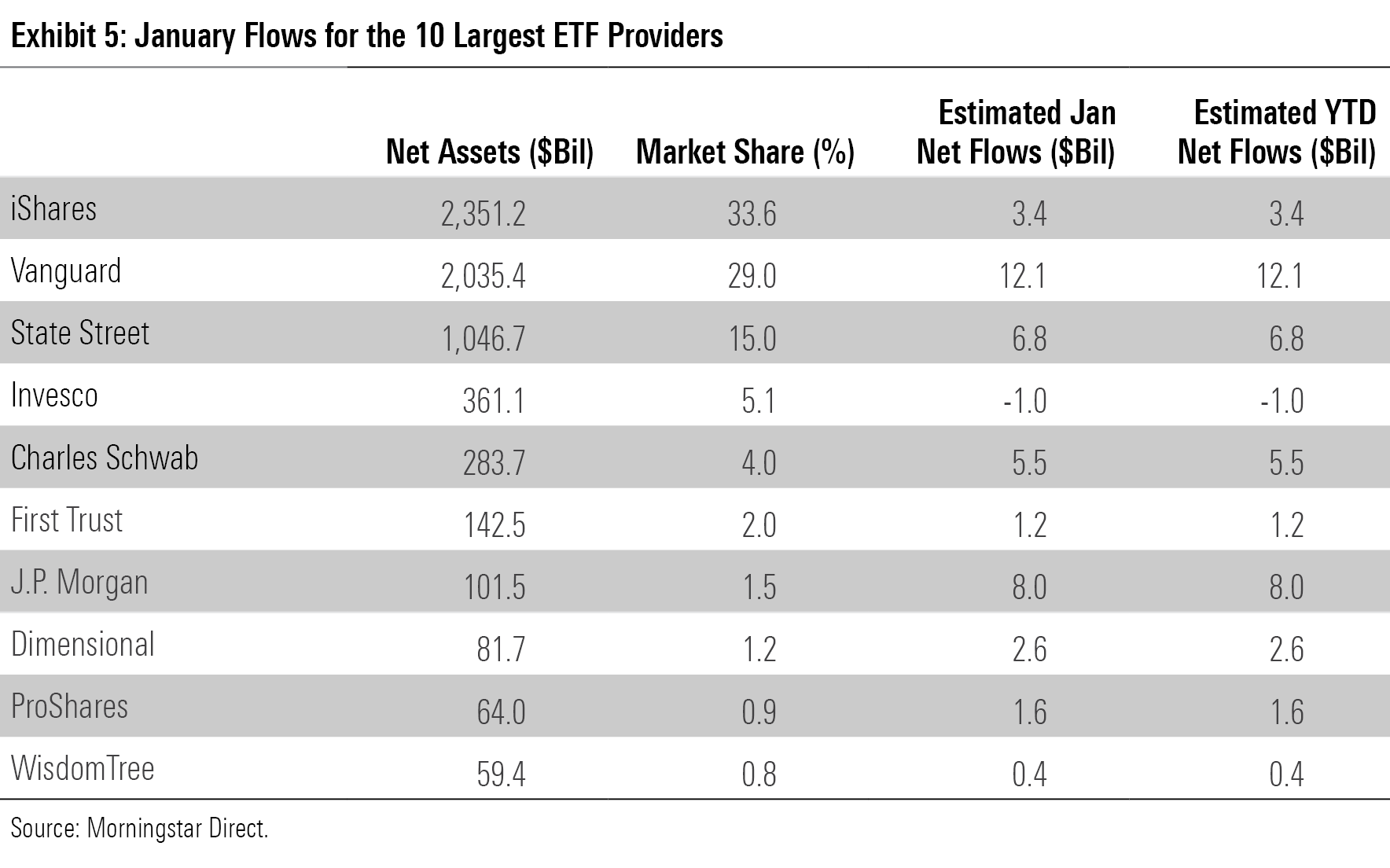

- Vanguard collected $12.1 billion to lead all ETF providers in January flows.

Interest-Rate Risk Pays Off

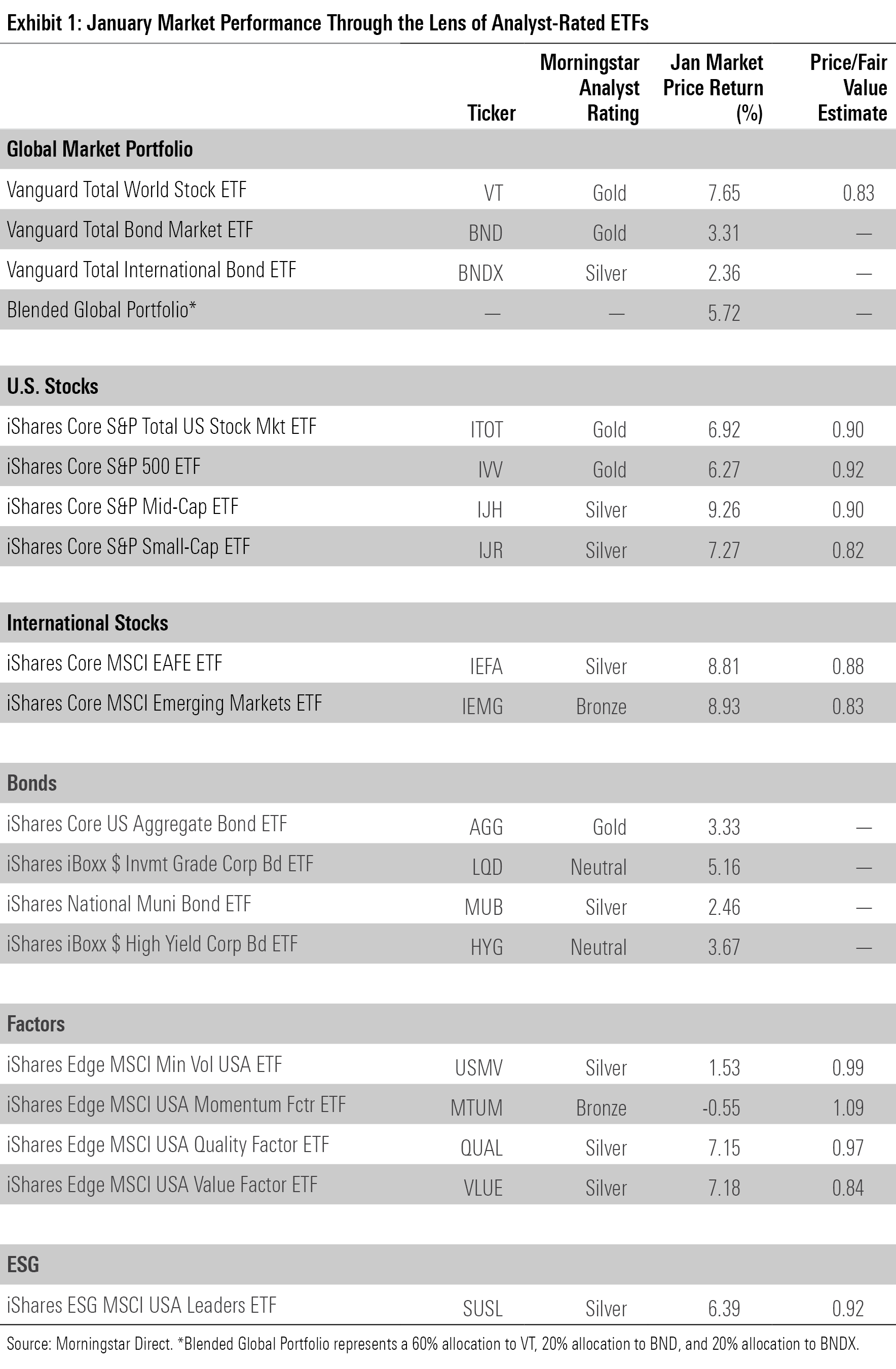

Exhibit 1 shows January returns for a sample of Morningstar analyst-rated ETFs that serve as proxies for major asset classes. A blended global portfolio earned a 5.72% return in January, a welcome change after a bruising year that called into question the merits of its 60/40 allocation.

After a historically bad year for bonds, the blended portfolio’s fixed-income sleeve returned to form in January. Vanguard Total Bond Market ETF BND and Vanguard Total International Bond ETF BNDX advanced 3.31% and 2.36%, respectively. Cooling inflation data helped the broad bond portfolios find their footing. Year-over-year inflation registered at 6.5% in December, its lowest rate since October 2021. Markets seemed convinced that wrangling inflation would slow—or halt altogether—the interest-rate hikes that sent bonds spiraling in 2022.

The sunnier interest-rate outlook benefited longer-dated bond funds most acutely. IShares 20+ Year Treasury Bond ETF TLT leapt 7.64%, its best monthly return since August 2019, while iShares Short Treasury Bond ETF SHV clocked a milder 0.33% gain. When it came to bonds, a longer time horizon was deadly in 2022. But investors that stuck with these funds—or better yet, bought them at a discount—have started to receive the premium embedded in their yields.

Riskier segments of the bond market performed well in January, too. IShares Broad USD Investment Grade Corporate Bond ETF USIG advanced 4.34%, and SPDR Bloomberg High Yield Bond ETF JNK climbed 4.03%. As the picture of a soft landing—slowing inflation without tipping into a recession—came into focus last month, funds that balance credit and interest-rate risks offered a glimpse of their potential strength in such an environment.

Foreign Equities Excel

International equities paced the global market in January. Vanguard Total International Stock ETF VXUS notched an 8.68% return, leading domestic counterpart Vanguard Total Stock Market ETF VTI for the third consecutive month. China and Taiwan helped its cause, turning their scorching ends to last year into starts to this one. The Morningstar China Index gained 11.31%, with Taiwanese stocks not far behind. Eurozone stocks measured up well in the developed-markets universe. Better-than-expected economic data and improving investor sentiment helped iShares MSCI Eurozone ETF EZU finish January 12.32% higher than where it started.

That said, VTI’s 6.93% January gain is nothing to sneeze at. Economic data that balanced cooling inflation with low unemployment and solid economic growth powered U.S. equities alongside bonds. The rosy economic picture overshadowed a mixed bag of corporate earnings, which showed signs of the difficult environment that many companies navigated in 2022.

After value stocks held up far better last year, growth stocks started 2023 on a tear. Vanguard Growth ETF VUG climbed 10.38% in January to beat Vanguard Value ETF VTV by about 7.5 percentage points. Growth stocks tend to be more sensitive to interest rates than value because their forecast cash flows lie further in the future. That underpinned their 2022 woes and subsequent January rebound.

January performance between different U.S. sectors neatly fit into the value/growth picture. Consumer Discretionary Select Sector SPDR ETF XLY, which features many of the market’s most richly valued companies, soared 15.13% last month. Its heaviest hitters rebounded from with gusto. Top holding Amazon.com AMZN gained 22.77%, and Tesla TSLA shot up 40.62%, tops among all stocks in the S&P 500. Communications Services Select Sector SPDR ETF XLC nearly went from worst to first after it ranked last in the SPDR suite of sector ETFs in 2022. It advanced 14.77% in January, as Meta Platforms META, Walt Disney DIS, and Netflix NFLX all gained between 20 and 25%. Meanwhile, sectors that provided bear-market ballast brought up the rear. Utilities Select Sector SPDR ETF XLU, Health Care Select Sector SPDR ETF XLV, and Consumer Staples Select Sector SPDR ETF XLP all finished January in the red.

Growth’s resurgence sparked a 7.15% return for iShares MSCI USA Quality Factor ETF QUAL. Prioritizing profitability pulls this fund toward companies whose healthy balance sheets earn them lofty valuations. So, when the market tilts in favor of growth stocks, QUAL tends to measure up well. A fund that wasn’t thrilled to see growth reclaim the mantle last month was iShares MSCI USA Momentum Factor ETF MTUM; its 60% combined stake in healthcare and energy stocks saddled it with a 0.55% loss. At each semiannual rebalance, this fund shapeshifts into whatever has performed best of late. The fund can find itself flat-footed when the market changes its identity on a dime, as U.S. stocks did in January.

Stock ETF Flows Don’t Jump Off the Page

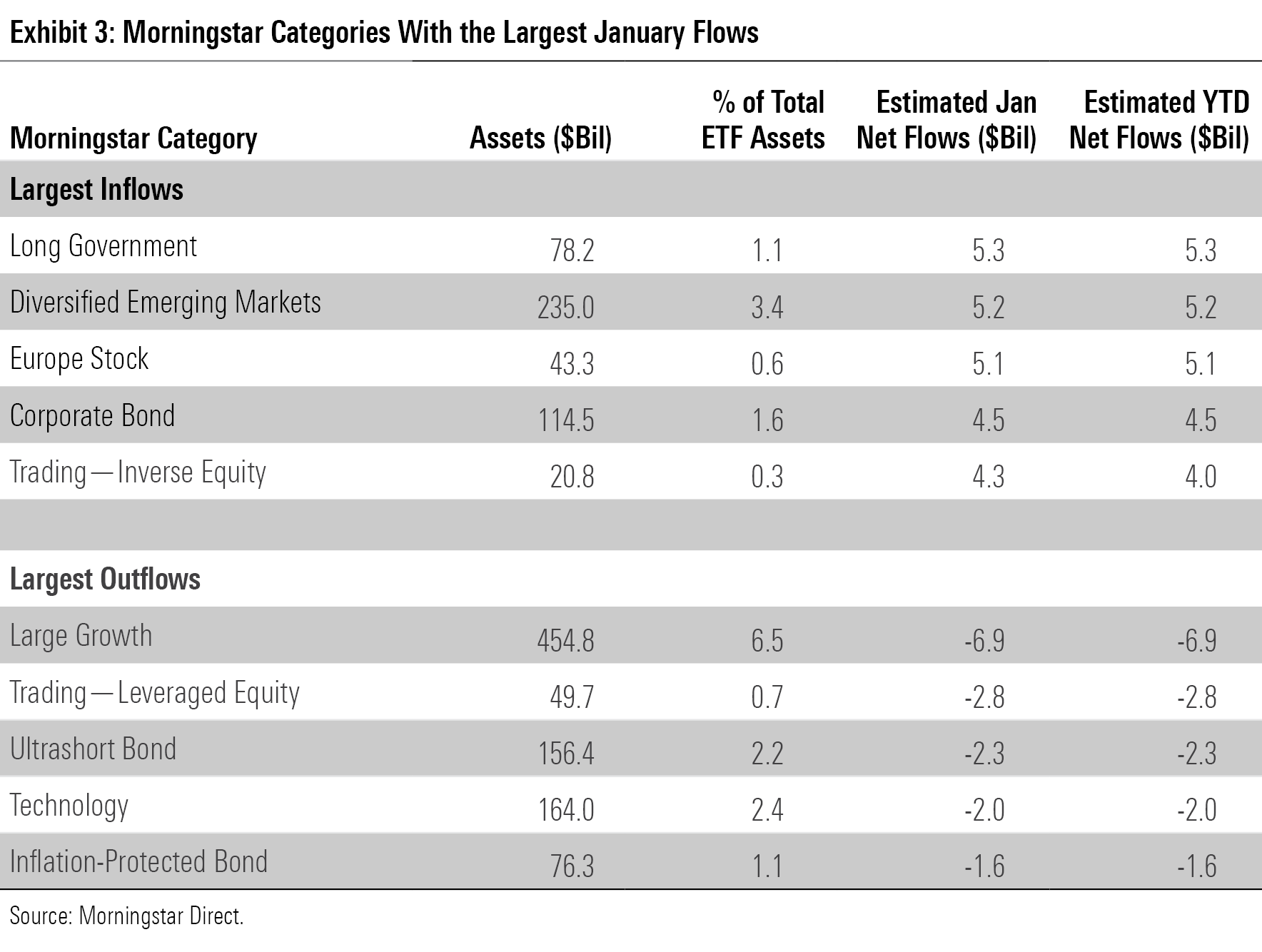

Stock ETFs absorbed $20.9 billion in January. That headline number translated into modest growth when scaled for its $5.3 trillion in assets. International-stock funds hauled in $20.7 billion, about 3 times as much as U.S. stock funds last month, despite entering the year with about one third the assets.

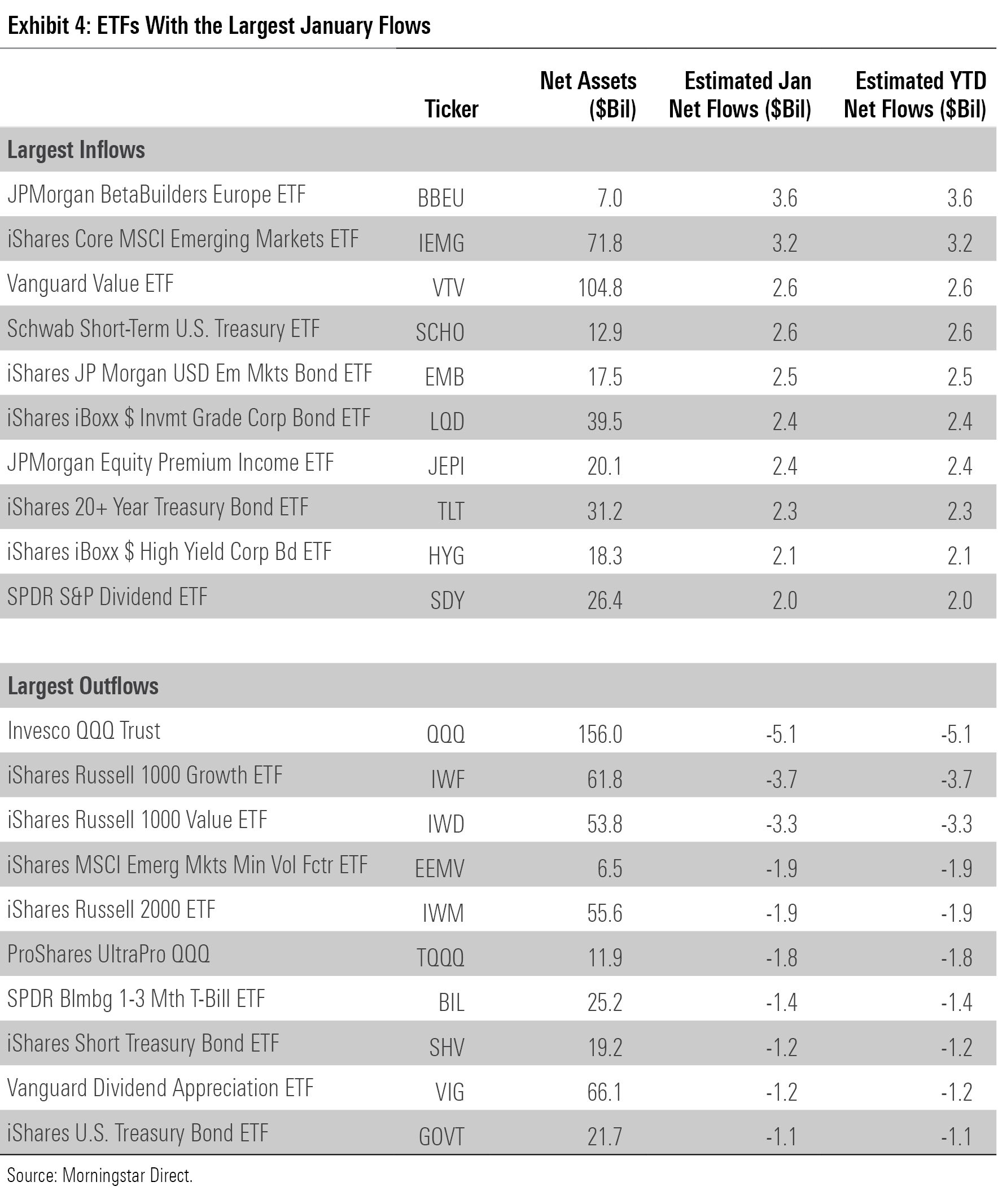

Diversified emerging-markets funds paced all stock Morningstar Categories with $5.2 billion in flows last month. Investors here kept it simple. IShares Core MSCI Emerging Markets ETF IEMG and iShares MSCI Emerging Markets ETF EEM—a pair of cut-and-dried, broadly diversified index funds—led the way with $3.2 billion and $1.4 billion in flows, respectively. Emerging-markets interest extended into specific markets. Chinese stock funds raked in $2.3 billion in January, their best monthly flow since June 2022. After most emerging-markets funds slid further than their domestic and developed-markets peers last year, investors moved on their chance to buy low at the start of this one.

U.S. stock funds finished January with modest outflows, their quietest month since they bled $33 billion in April 2022. About $2.1 billion flowed into active funds, indicating a solid start to 2023 after an excellent 2022. Systematic funds that straddle the line between active and passive fared well. Dimensional US Core Equity 2 ETF DFAC, Avantis U.S. Small Cap Value ETF AVUV, and Avantis U.S. Equity ETF AVUS each reeled in between $150 million and $350 million. Those figures won’t shatter records, but they were competitive in a month when stalwarts like iShares Core S&P 500 ETF IVV, Vanguard S&P 500 ETF VOO, and SPDR S&P 500 ETF Trust SPY all failed to crack $1 billion of inflows.

Funds that reside in the inverse equity category pulled in $4 billion in January, fifth-most among all categories. These funds offer inverse performance of a certain reference index, so it’s a bearish indicator when investors pile into them. ProShares UltraPro Short QQQ SQQQ, which provides triple-leveraged exposure to the inverse of the Nasdaq 100 Index’s daily returns, absorbed $1.9 billion in January. Combine that with Nasdaq 100 tracker Invesco QQQ Trust’s QQQ market-worst $5.1 billion outflow, and it’s clear that few investors wanted to touch the tech-heavy benchmark in January. But trying to time the market again proved a fool’s errand: The index leapt 10.67% in January, its best month since July 2022.

Bond ETF Flows Pile Up

Investors piled into bond ETFs toward the end of 2022 and continued their march in 2023. Bond ETFs raked in $24.5 billion in January, rivaling their stock counterparts despite holding about one fourth the total assets. This follows a calendar year in which fixed-income ETFs posted about a 15% organic growth rate, well ahead of stock ETFs’ 6.4% clip.

Treasury funds were some of the most popular choices in January. Long government bond funds led all categories with $5.3 billion in flows, and short- and intermediate-term ETFs collectively welcomed about $5 billion. Long-term Treasury funds excelled in January, a turnaround that was met with a chorus of “about time” from the investors who sunk $36 billion into these funds in 2022. As devotion to duration was finally rewarded in January, funds that offer the most of it continued to accumulate flows.

Bond funds that shoulder more credit risk carried flow momentum from last year into 2023. Corporate bond ETFs raked in $4.5 billion in January, their most lucrative month since summer 2020. IShares iBoxx $ Investment Grade Corporate Bond ETF LQD led the charge with a $2.4 billion inflow that tripled its next-closest competitor. High-yield bond funds welcomed $1.1 billion of new money. Flows into these funds have oscillated in recent years, but they seemed to stabilize after collectively reeling in $15 billion in last year’s final quarter. Narrowing credit spreads should only continue that trend.

The methodical exodus from inflation-protected bond funds continued in January. These funds leaked $1.6 billion last month, cementing their fifth consecutive month of outflows. No fund better encapsulates inflation-protected bond funds’ recent rise and fall better than iShares TIPS Bond ETF TIP. The fund’s $38.7 billion in assets at the end of 2021 dwindled to $23 billion by the end of January 2023 after it shed $10 billion and failed to deliver the advertised inflation protection in the interim. Inflation-protected bond funds may well reverse the outflow trend soon, but recent struggles have left them with a black eye.

Parental Guidance

The usual suspects crowded the list of January’s flow leaders. Vanguard reeled in $12.1 billion to lead the way, while iShares welcomed a modest $3.4 billion of new money.

IShares is one of only a few serious contenders to stop Vanguard from extending its annual ETF inflows win streak to four calendar years. If iShares wants to reclaim the crown, its stock ETFs need to find their groove. Excellent flows into iShares’ fixed-income lineup concealed a ho-hum year for its stock offerings in 2022. Its taxable-bond funds pulled in about $86.4 billion last year (16.9% organic growth rate), while its U.S. stock lineup drew in $46.9 billion (3.9%). So far, it looks like more of the same in 2023: iShares bond funds collected about $14.3 billion in January, and stock ETFs saw over $9.0 billion leave their doors.

Just behind the two behemoths was J.P. Morgan; its $8 billion collection marked its best monthly inflow since June 2020. Active ETFs powered J.P. Morgan in 2022, but this year started on a more balanced note. Investors poured about $3.4 billion into its active ETFs, as the unofficial 2022 ETF flows MVP, JPMorgan Equity Premium Income ETF JEPI, raked in another $2.4 billion. Not to be outdone, the passive lineup pulled in $4.5 billion of its own. For those still unsure why J.P. Morgan recently converted several systematic active bond ETFs into new members of its passive BetaBuilders suite, kindly see the $3.6 billion that JPMorgan BetaBuilders Europe ETF BBEU absorbed in January.

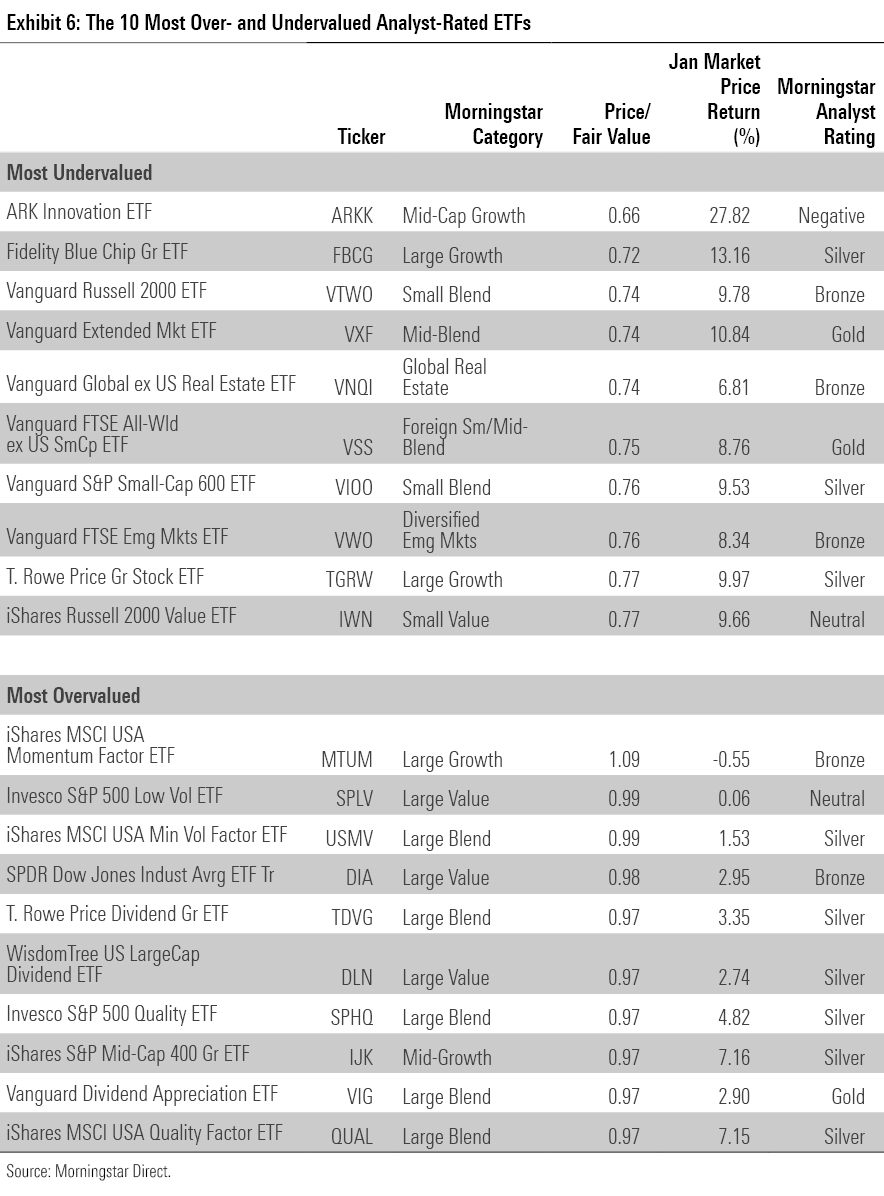

International Small Caps Look Cheap

The fair value estimate for ETFs rolls up our equity analysts’ fair value estimates for individual stocks and our quantitative fair value estimates for stocks not covered by Morningstar analysts into an aggregate fair value estimate for stock ETF portfolios. Dividing an ETF’s market price by this value yields its price/fair value ratio. This ratio can point to potential bargains and areas of the market where valuations are stretched.

Many international small-cap funds are available at an attractive discount, even after a solid month in the markets lifted valuations worldwide. These stocks slid further than their large-cap peers in 2022 and failed to race ahead of them in January. Their lethargic rebound held Vanguard FTSE All-World ex US Small Cap ETF VSS 25% below its fair value at the end of January. Gold-rated for its diversified portfolio and ultralow fee, this fund should excel if international stocks sustain the momentum they started to build in January. Bronze-rated iShares MSCI EAFE Small-Cap ETF SCZ is another sound option at an 18% discount to fair value.

Dividend funds were all the rage in 2022, but their resilience has left them with richer valuations than many of their harder-hit peers. Both WisdomTree U.S. LargeCap Dividend ETF DLN and Vanguard High Dividend Yield ETF VYM—large-value funds that mechanically favor cheaper stocks—sported loftier price/fair value ratios than IVV at January’s end. To be fair, both ETFs held up far better than the broad-market fund over the trailing 12 months. But investors should beware that the best value does not always lie in the value categories.

Correction (Feb. 7, 2023): Because of a data collection error, a previous version of this article overstated January’s ETF inflows by about $8 billion. The overall flows figure has been corrected to $47 billion. Previously unrecorded outflows from a suite of iShares ETFs accounted for most of the difference. IShares finished January with an estimated $3.4 billion net inflow, not $11.8 billion. Exhibits 2 through 5 have been updated.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/30e2fda6-bf21-4e54-9e50-831a2bcccd80.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-09-2024/t_e87d9a06e6904d6f97765a0784117913_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/30e2fda6-bf21-4e54-9e50-831a2bcccd80.jpg)