Wheaton (WPM) Q2 Earnings & Sales Beat Estimates, '22 View Down

Wheaton Precious Metals Corp. WPM reported adjusted EPS of 33 cents in second-quarter 2022, beating the Zacks Consensus Estimate of 32 cents. The bottom line declined 7.8% year over year.

The company generated revenues of $303 million during the reported quarter, down 8% on a year-over-year basis. The downside was caused by a 5% decline in the average realized gold equivalent price and a 3% decline in the number of Gold Equivalent Ounces sold. The top line surpassed the Zacks Consensus Estimate of $301 million.

Wheaton’s gold production was 68,365 ounces, up from the prior-year quarter’s 90,072 ounces. Attributable silver production inched up 0.1% year over year to 6,537 ounces, while palladium production declined 26% to 3,899 ounces. The company sold 170,371 GEOs during the June-end quarter, down 3.5% from the prior-year quarter’s 176,502 GEOs.

Wheaton Precious Metals Corp. Price, Consensus and EPS Surprise

Wheaton Precious Metals Corp. price-consensus-eps-surprise-chart | Wheaton Precious Metals Corp. Quote

Prices

In second-quarter 2022, the average realized gold price was $1,872 per ounce. The figure was 4% higher than the year-ago quarter’s figure. Silver prices averaged $22.27 per ounce in the reported quarter, down 16.6% year on year. Palladium prices fell 23.7% year over year to $2,132 per ounce.

Financial Position

The company had $449 million of cash in hand at the end of second-quarter 2022 compared with $226 million at the 2021-end. It recorded an operating cash flow of $206 million in the second quarter compared with $216 million in the year-ago quarter. Wheaton has added a sustainability-linked element in connection with the extension to its existing undrawn $2 billion revolving credit facility.

Business Update

On Jul 5, 2022, Wheaton entered into an agreement with Hecla Mining Company HL to terminate its existing silver stream on Alexco Resource Corp.'s AXU Keno Hill Silver property for $135 million. The termination is conditional upon the completion of Hecla's acquisition of Alexco.

Wheaton will have a 5.6% shareholding interest in Hecla’s shares after the Keno Hill silver stream deal ends. The move supports WPM’s focus on boosting shareholders’ value by strategically identifying opportunities inside and outside of its portfolio.

Guidance

Wheaton’s attributable production is now estimated to be between 640,000 GEOs and 680,000 GEOs for the current year. Gold production is expected in the band of 300,000-320,000 ounces. Silver production is projected between 22.5 million ounces and 24.0 million ounces, while production of other metals is anticipated in the band of 35,000-40,000 GEOs. The guidance is lower than the previously-issued guidance owing to the proposed termination of the Keno Hill agreement, lower production from Stillwater due to severe weather and flooding as well as lower than expected production at the Salobo mine.

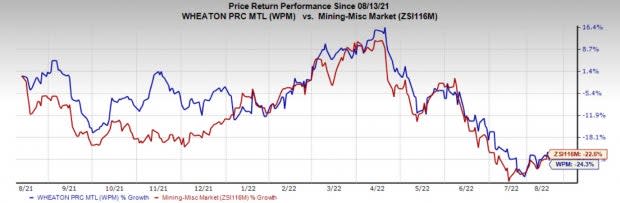

Price Performance

Shares of Wheaton have declined 24.3% in the past year compared with the industry’s fall of 22.6%.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

Wheaton currently carries a Zacks Rank #3 (Hold). A better-ranked stock in the basic materials space includes Ashland Global Holdings Inc. ASH.

Ashland, currently carrying a Zacks Rank #2 (Buy), has a projected earnings growth rate of 50.9% for fiscal 2022. The Zacks Consensus Estimate for ASH’s fiscal 2022 earnings has been revised 10.5% upward in the past 60 days. You can see the complete list of today’s Zacks #1 Rank (strong Buy) stocks here.

ASH’s earnings beat the Zacks Consensus Estimate in three of the trailing four quarters. It has a trailing four-quarter earnings surprise of roughly 1.82%, on average. ASH shares are up around 20.9% in a year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ashland Inc. (ASH) : Free Stock Analysis Report

Hecla Mining Company (HL) : Free Stock Analysis Report

Alexco Resource Corp (AXU) : Free Stock Analysis Report

Wheaton Precious Metals Corp. (WPM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research