Cross-Sector: Market Data Highlights

CROSS-SECTOR

DATA REPORT

24 March 2022

CLIENT SERVICES

Americas

1-212-553-1653

Asia Pacific

852-3551-3077

Japan

81-3-5408-4100

EMEA

44-20-7772-5454

ABOUT CAPITAL MARKETS RESEARCH

Analyses from Moody’s Capital Markets

Research, Inc. (CMR) focus on explaining

signals from the credit and equity markets.

The publications address whether market

signals, in the opinion of the group’s analysts,

accurately reflect the risks and investment

opportunities associated with issuers and

sectors. CMR research thus complements the

fundamentally-oriented research offered by

Moody’s Investors Service (MIS), the rating

agency.

CMR is part of Moody’s Analytics, which

is one of the two operating businesses

of Moody’s Corporation. Moody’s

Analytics (including CMR) is legally and

organizationally separated from Moody’s

Investors Service and operates on an arm’s

length basis from the ratings business.

CMR does not provide investment advisory

services or products.

View the CMR FAQ

Contact us

Follow us on Twitter

Cross-Sector

Market Data Highlights

The latest market data from Weekly Market Outlook. Click

for access to the full WMO.

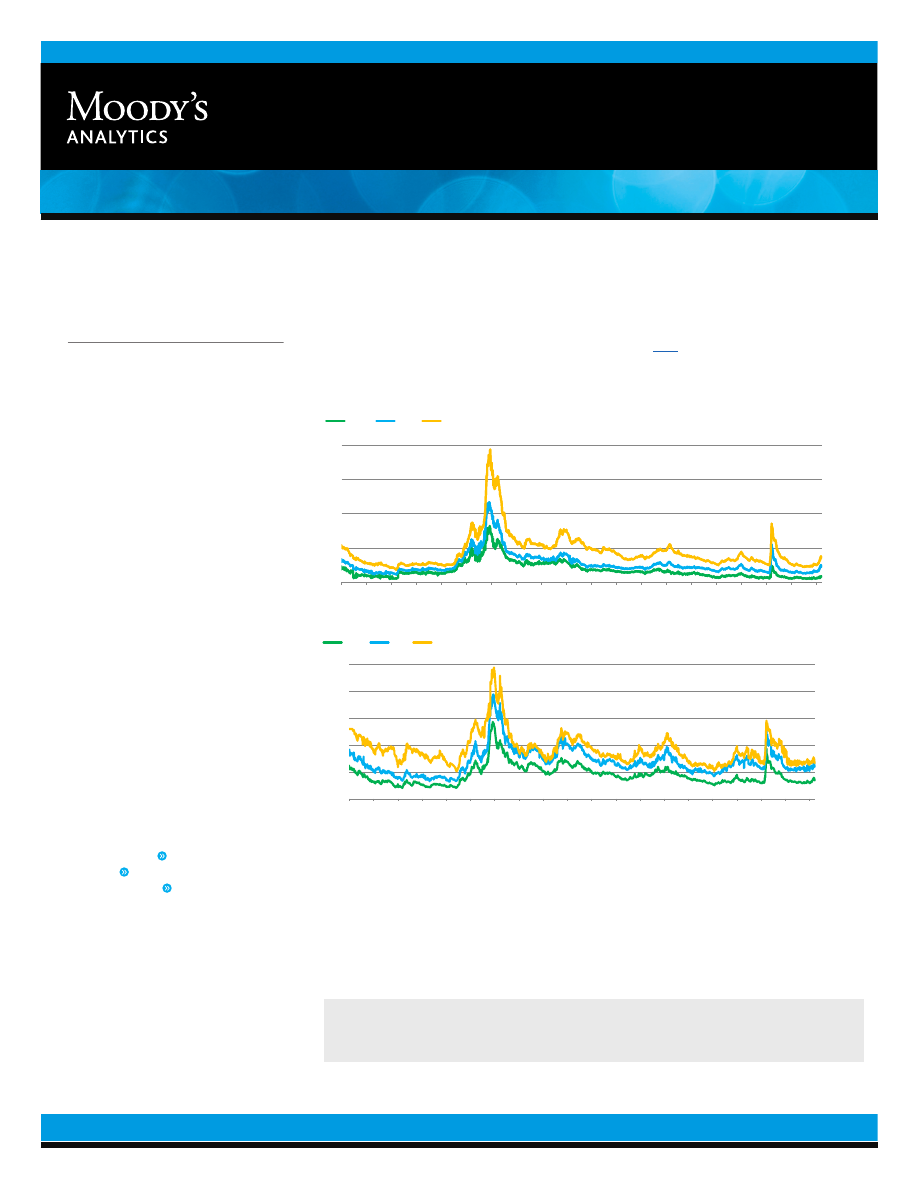

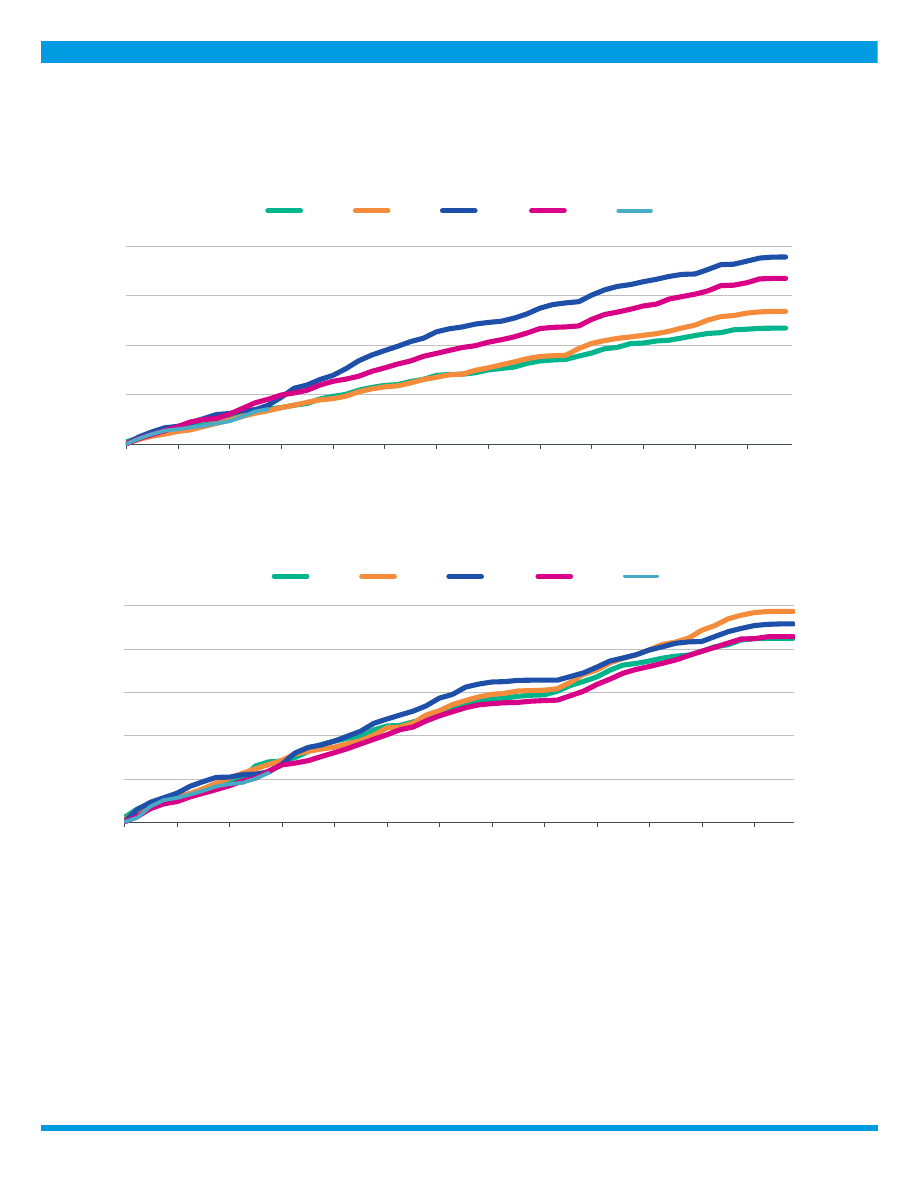

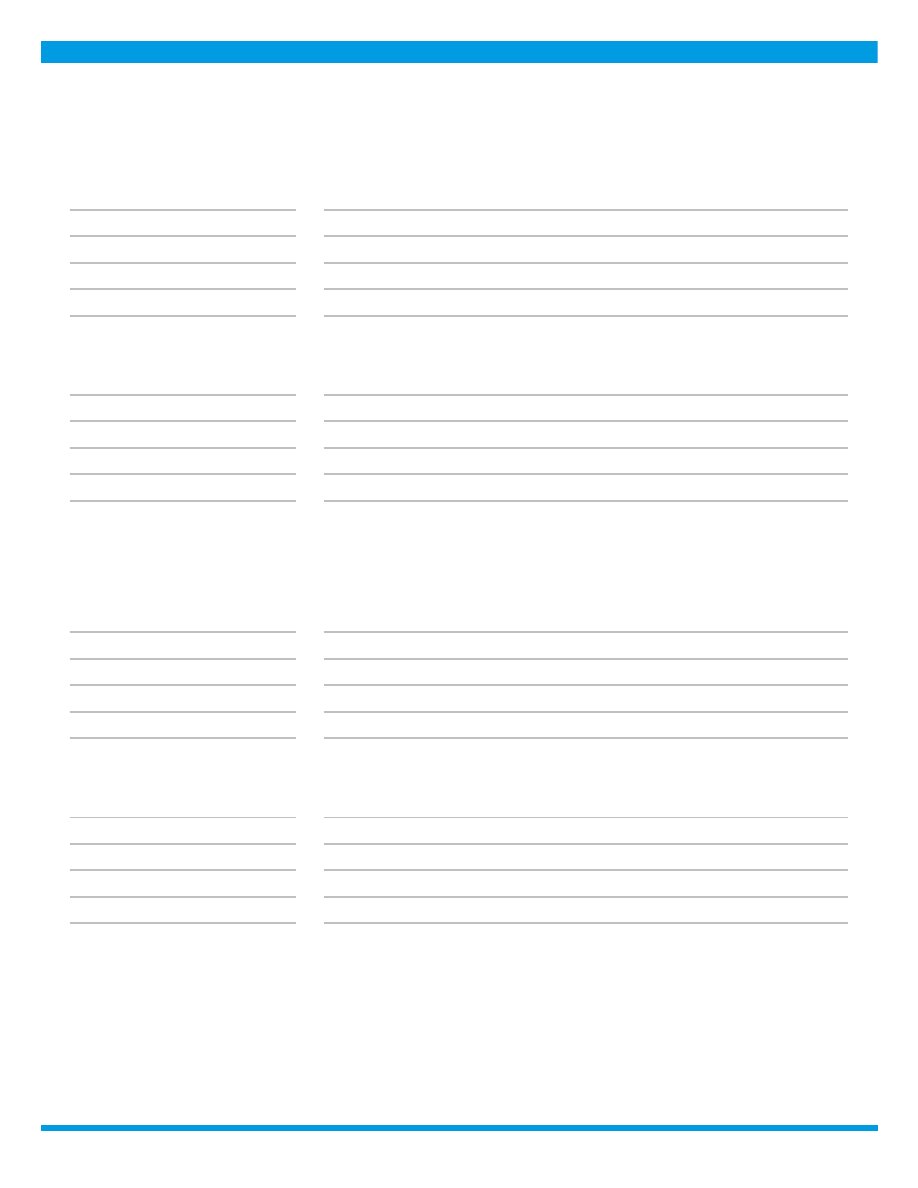

SPREADS

0

200

400

600

800

0

200

400

600

800

2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022

Spread (bp)

Spread (bp)

Aa2

A2

Baa2

Source: Moody's

Figure 1: 5-Year Median Spreads-Global Data (High Grade)

0

400

800

1,200

1,600

2,000

0

400

800

1,200

1,600

2,000

2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022

Spread (bp)

Spread (bp)

Ba2

B2

Caa-C

Source: Moody's

Figure 2: 5-Year Median Spreads-Global Data (High Yield)

Moody’s Analytics markets and distributes all Moody’s Capital Markets Research, Inc. materials. Moody’s Capital Markets

Research,Inc. is a subsidiary of Moody’s Corporation. Moody’s Analytics does not provide investment advisory services or

products. For further detail, please see the last page.

MOODY'S ANALYTICS

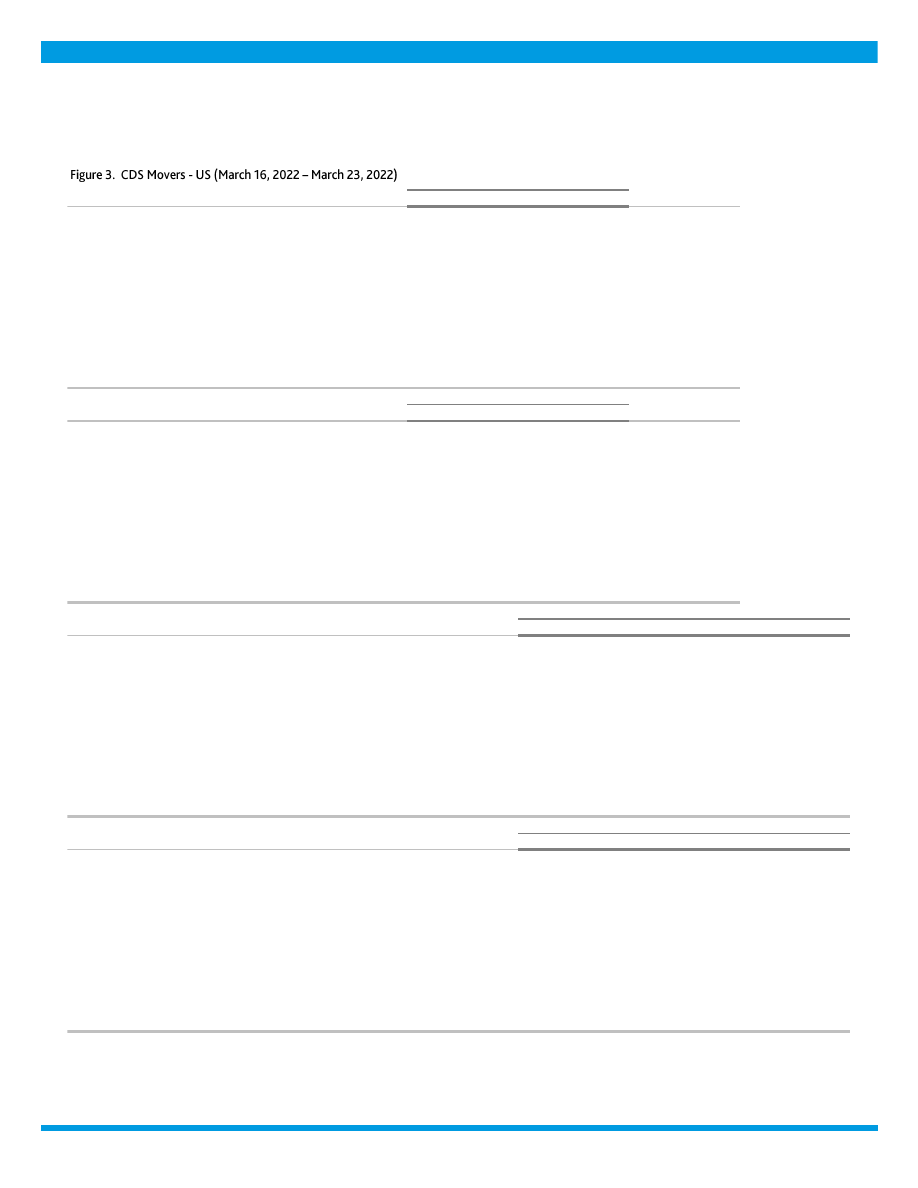

CROSS-SECTOR

CDS MOVERS

CDS Implied Rating Rises

Issuer

Mar. 23

Mar. 16

Senior Ratings

Abbott Laboratories

Aa2

A1

A1

JPMorgan Chase & Co.

Baa1

Baa2

A2

Citigroup Inc.

Baa2

Baa3

A3

Goldman Sachs Group, Inc. (The)

Baa2

Baa3

A2

Wells Fargo & Company

Baa1

Baa2

A1

JPMorgan Chase Bank, N.A.

A3

Baa1

Aa2

Comcast Corporation

A2

A3

A3

Oracle Corporation

Baa2

Baa3

Baa2

CVS Health Corporation

A1

A2

Baa2

Exxon Mobil Corporation

Aa1

Aa2

Aa2

CDS Implied Rating Declines

Issuer

Mar. 23

Mar. 16

Senior Ratings

CenterPoint Energy, Inc.

Baa2

A3

Baa2

PepsiCo, Inc.

A2

A1

A1

Philip Morris International Inc.

A2

A1

A2

General Electric Company

Baa3

Baa2

Baa1

Eli Lilly and Company

Aa2

Aa1

A2

FirstEnergy Corp.

Baa3

Baa2

Ba1

Emerson Electric Company

Baa1

A3

A2

Danaher Corporation

A3

A2

Baa1

Archer-Daniels-Midland Company

A2

A1

A2

United Rentals ( North America ), Inc.

Ba2

Ba1

Ba2

CDS Spread Increases

Issuer

Senior Ratings

Mar. 23

Mar. 16

Spread Diff

Talen Energy Supply, LLC

Caa2

10,691

7,717

2,973

American Airlines Group Inc.

Caa1

1,192

1,014

178

United Airlines Holdings, Inc.

Ba3

728

637

91

Liberty Interactive LLC

B2

761

703

58

Goodyear Tire & Rubber Company (The)

B2

432

387

45

Macy's Retail Holdings , LLC

Ba2

360

325

35

American Axle & Manufacturing , Inc.

B2

525

493

32

Embarq Corporation

Ba2

315

285

30

Xerox Corporation

Ba2

358

330

28

Beazer Homes USA, Inc.

B3

469

446

24

CDS Spread Decreases

Issuer

Senior Ratings

Mar. 23

Mar. 16

Spread Diff

Nabors Industries , Inc.

Caa2

502

583

-82

Staples, Inc.

Caa2

1,231

1,311

-80

Rite Aid Corporation

Caa2

1,356

1,412

-56

Murphy Oil Corporation

Ba3

263

318

-54

Nissan Motor Acceptance Company LLC

Baa3

247

275

-28

Avis Budget Car Rental, LLC

B2

332

357

-26

Tenet Healthcare Corporation

B3

281

302

-21

Travel + Leisure Co.

B1

217

237

-21

Occidental Petroleum Corporation

Ba1

129

149

-20

Calpine Corporation

B2

424

444

-19

Source: Moody's, CMA

CDS Spreads

CDS Implied Ratings

CDS Implied Ratings

CDS Spreads

2 24 March 2022

Cross-Sector: Market Data Highlights

MOODY'S ANALYTICS

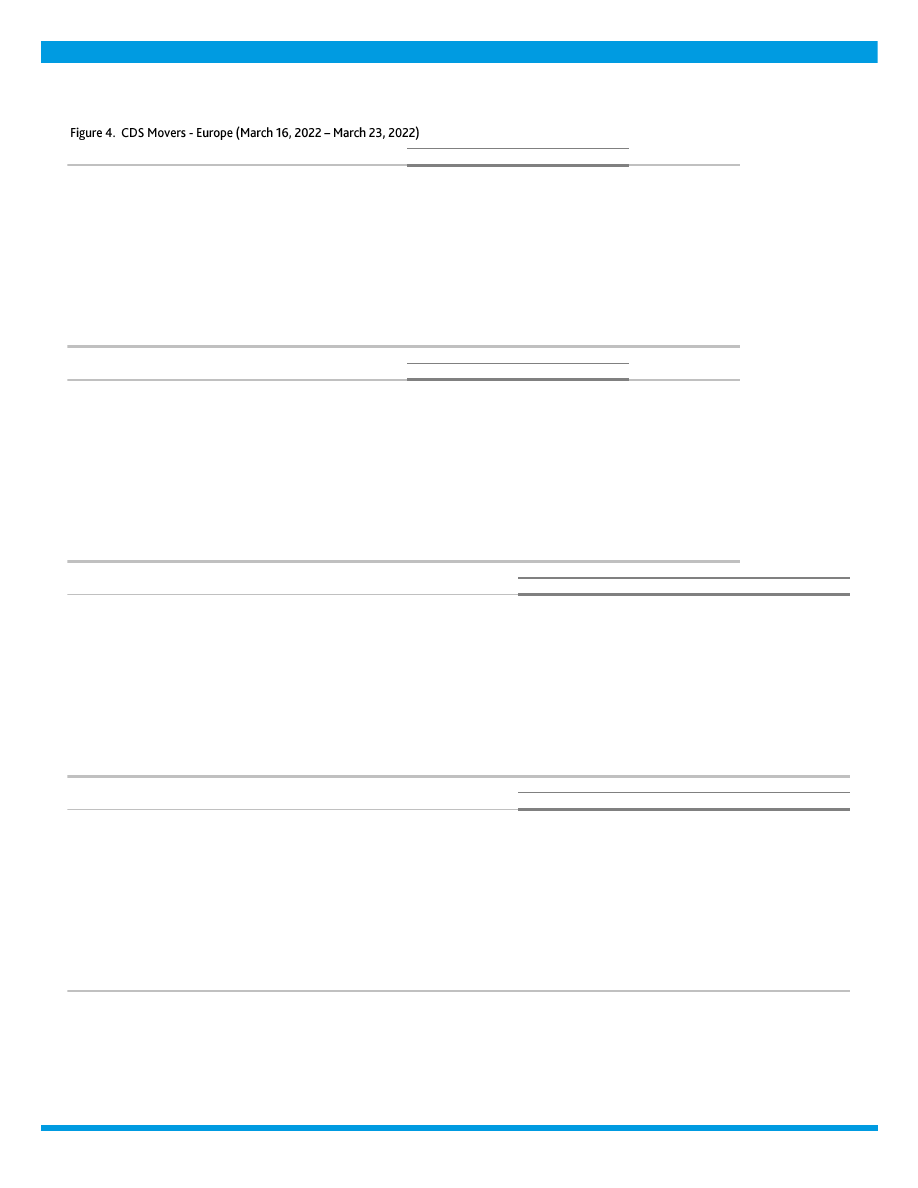

CROSS-SECTOR

CDS Implied Rating Rises

Issuer

Mar. 23

Mar. 16

Senior Ratings

ASML Holding N.V.

Aa2

A1

A2

UniCredit Bank AG

A2

A3

A2

ENEL S.p.A .

Baa2

Baa3

Baa1

Anheuser-Busch InBev SA /NV

A3

Baa1

Baa1

Heineken N.V.

Aa1

Aa2

Baa1

Telia Company AB

A1

A2

Baa1

Iberdrola International B.V.

A3

Baa1

Baa1

Veolia Environnement S.A.

A2

A3

Baa1

Autoroutes du Sud de la France (ASF)

A2

A3

A3

National Grid Electricity Transmission plc

A2

A3

Baa1

CDS Implied Rating Declines

Issuer

Mar. 23

Mar. 16

Senior Ratings

Spain , Government of

Aa3

Aa2

Baa1

NatWest Markets Plc

Baa1

A3

A2

Swedbank AB

A2

A1

Aa3

Landesbank Hessen-Thueringen GZ

Aa3

Aa2

Aa3

SEB AB

A1

Aa3

Aa3

EnBW Energie Baden-Wuerttemberg AG

A3

A2

Baa1

thyssenkrupp AG

Ba3

Ba2

B1

Coca-Cola HBC Finance B.V .

A3

A2

Baa1

NatWest Markets N.V.

Aa2

Aa1

A2

adidas AG

Aa3

Aa2

A2

CDS Spread Increases

Issuer

Senior Ratings

Mar. 23

Mar. 16

Spread Diff

Vue International Bidco plc

Ca

1,122

835

287

Banco Comercial Portugues, S.A.

Ba1

252

205

47

thyssenkrupp AG

B1

306

259

47

Casino Guichard-Perrachon SA

Caa1

956

911

45

Sappi Papier Holding GmbH

Ba2

353

333

19

Valeo S.E.

Baa3

243

227

16

Piraeus Financial Holdings S.A.

Caa2

698

684

14

Renault S.A.

Ba2

308

295

14

Ziggo Bond Company B.V.

B3

306

292

14

TDC Holding A/S

B2

186

172

14

CDS Spread Decreases

Issuer

Senior Ratings

Mar. 23

Mar. 16

Spread Diff

Boparan Finance plc

Caa1

1,758

2,100

-341

Novafives S.A.S.

Caa2

1,041

1,092

-51

Vedanta Resources Limited

B3

856

900

-44

UPC Holding B.V.

B3

205

230

-25

Fortum Oyj

Baa2

195

213

-19

Banca Monte dei Paschi di Siena S.p.A .

Caa1

463

477

-14

Hammerson Plc

Baa3

187

200

-13

FCE Bank plc

Baa3

182

191

-9

Deutsche Lufthansa Aktiengesellschaft

Ba2

309

316

-7

Jaguar Land Rover Automotive Plc

B1

552

559

-7

Source: Moody's, CMA

CDS Spreads

CDS Implied Ratings

CDS Implied Ratings

CDS Spreads

3 24 March 2022

Cross-Sector: Market Data Highlights

MOODY'S ANALYTICS

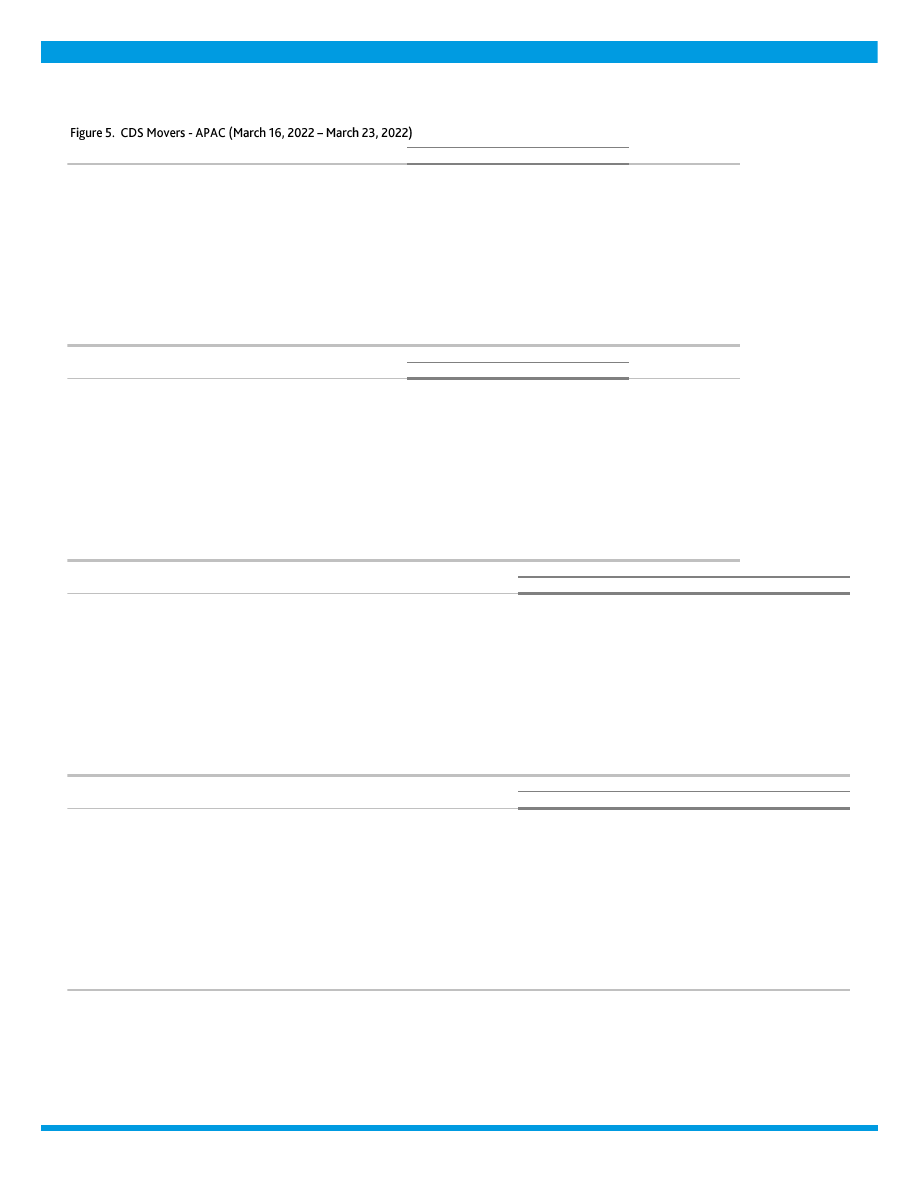

CROSS-SECTOR

CDS Implied Rating Rises

Issuer

Mar. 23

Mar. 16

Senior Ratings

Nippon Yusen Kabushiki Kaisha

A1

Baa1

Ba3

JFE Holdings, Inc.

Aa3

A2

Baa3

Honda Motor Co., Ltd.

Aa1

Aa3

A3

Indonesia , Government of

Baa2

Baa3

Baa2

Export-Import Bank of Korea (The)

Aa1

Aa2

Aa2

China Development Bank

Baa1

Baa2

A1

Export-Import Bank of China (The)

A3

Baa1

A1

SoftBank Group Corp.

B1

B2

Ba3

Chubu Electric Power Company, Incorporated

Aa1

Aa2

A3

Industrial & Commercial Bank of China Ltd

Baa1

Baa2

A1

CDS Implied Rating Declines

Issuer

Mar. 23

Mar. 16

Senior Ratings

Westpac Banking Corporation

A2

A1

Aa3

National Australia Bank Limited

A1

Aa3

Aa3

Commonwealth Bank of Australia

A1

Aa3

Aa3

DBS Bank Ltd.

A1

Aa3

Aa1

Wesfarmers Limited

A2

A1

A3

Nippon Telegraph and Telephone Corporation

Aa1

Aaa

A1

Singapore Telecommunications Limited

A2

A1

A1

Japan , Government of

Aaa

Aaa

A1

China , Government of

A3

A3

A1

Australia , Government of

Aaa

Aaa

Aaa

CDS Spread Increases

Issuer

Senior Ratings

Mar. 23

Mar. 16

Spread Diff

Halyk Savings Bank of Kazakhstan

Ba2

437

402

35

Macquarie Group Limited

A3

79

71

7

Chorus Limited

Baa2

81

74

7

Westpac Banking Corporation

Aa3

52

46

6

National Australia Bank Limited

Aa3

47

41

6

East Japan Railway Company

A1

31

25

6

Woolworths Group Limited

Baa2

68

62

6

Commonwealth Bank of Australia

Aa3

45

40

5

Macquarie Bank Limited

A2

52

47

5

Telstra Corporation Limited

A2

55

50

5

CDS Spread Decreases

Issuer

Senior Ratings

Mar. 23

Mar. 16

Spread Diff

Development Bank of Kazakhstan

Baa2

298

362

-64

SoftBank Group Corp.

Ba3

372

423

-50

Kazakhstan , Government of

Baa2

167

201

-34

Nissan Motor Co., Ltd.

Baa3

141

161

-20

Nippon Yusen Kabushiki Kaisha

Ba3

47

63

-16

Mitsui O.S.K. Lines, Ltd.

B1

64

80

-15

Industrial & Commercial Bank of China Ltd

A1

66

80

-14

Bank of China Limited

A1

66

78

-13

Bank of East Asia, Limited

A3

70

81

-12

China Development Bank

A1

68

78

-9

Source: Moody's, CMA

CDS Implied Ratings

CDS Implied Ratings

CDS Spreads

CDS Spreads

4 24 March 2022

Cross-Sector: Market Data Highlights

MOODY'S ANALYTICS

CROSS-SECTOR

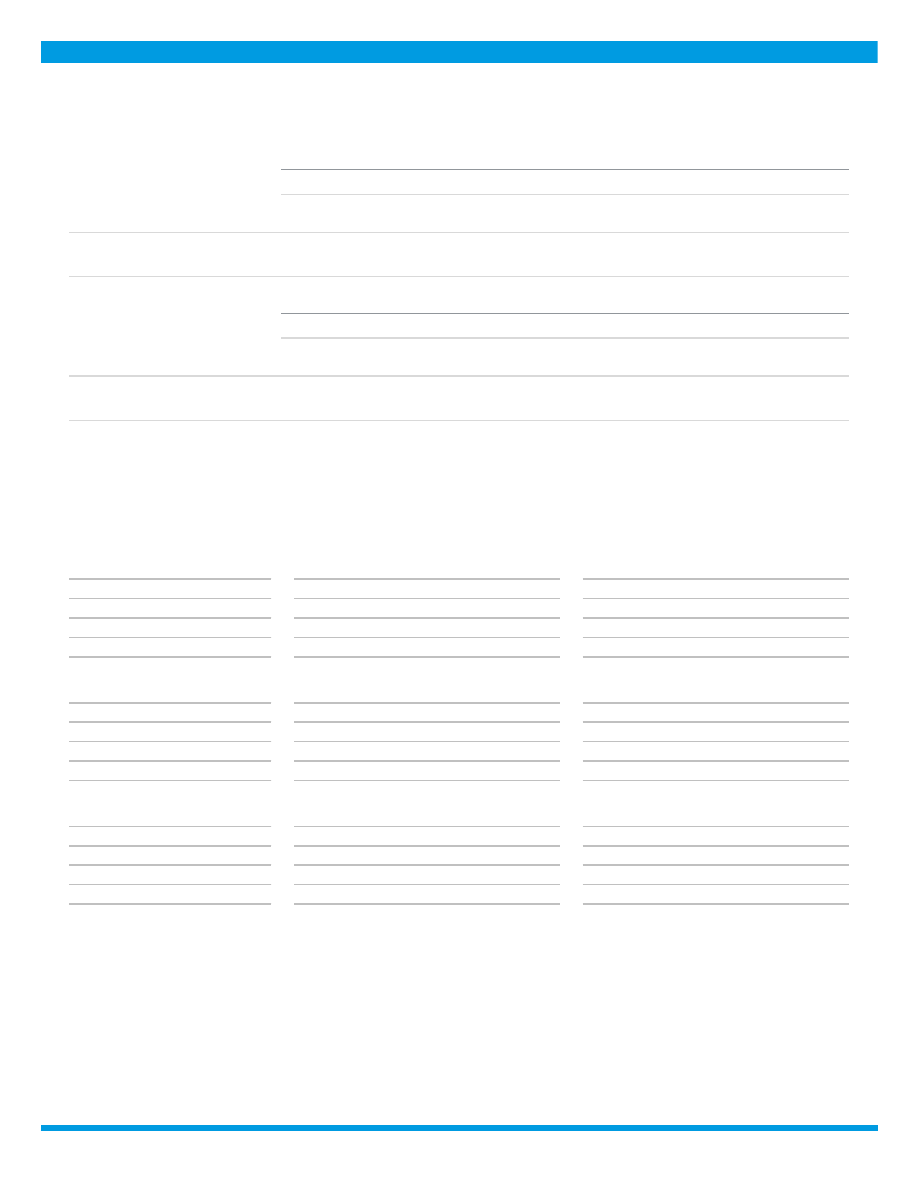

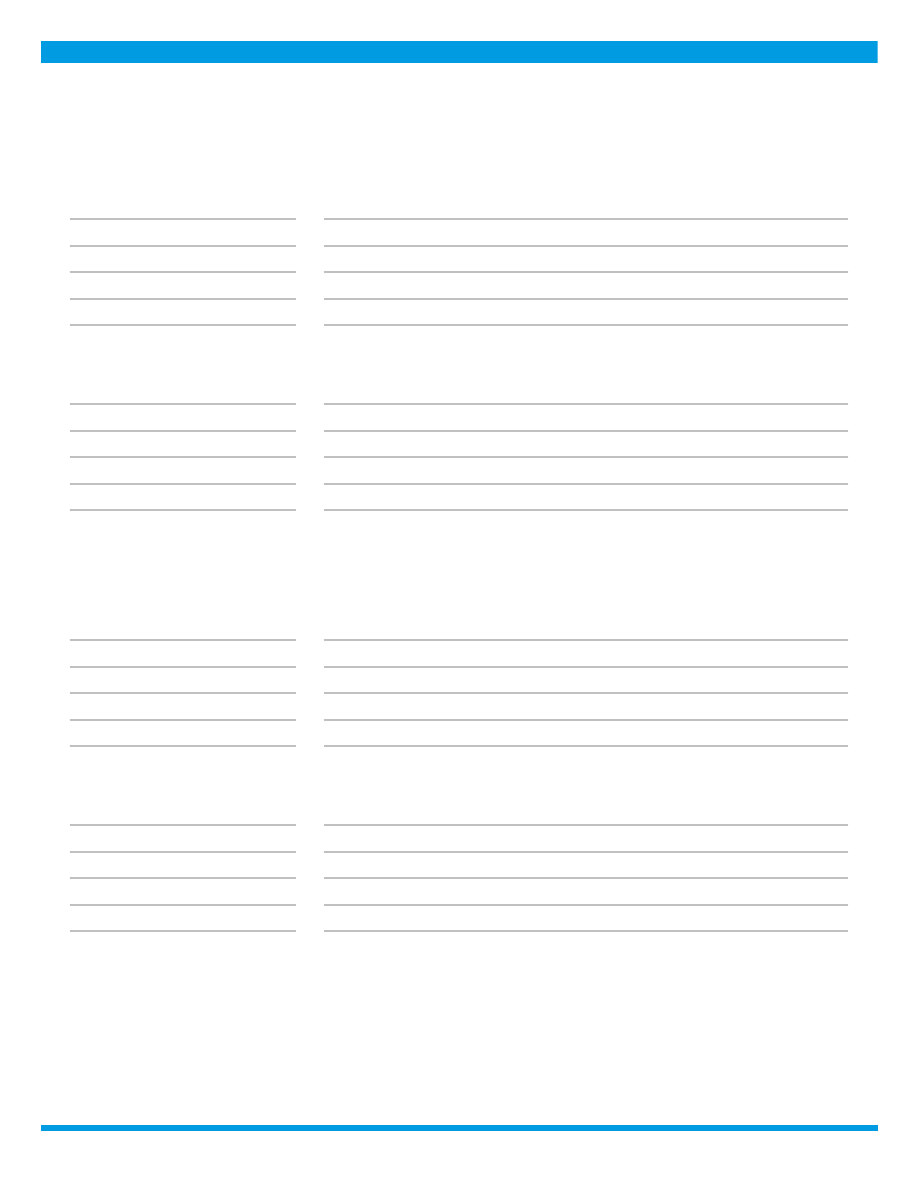

ISSUANCE

0

700

1,400

2,100

2,800

0

700

1,400

2,100

2,800

Jan Feb Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Issuance ($B)

Issuance ($B)

2018

2019

2020

2021

2022

Source:

Moody's / Dealogic

Figure 6. Market Cumulative Issuance - Corporate & Financial Institutions: USD Denominated

0

200

400

600

800

1,000

0

200

400

600

800

1,000

Jan Feb Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Issuance ($B)

Issuance ($B)

2018

2019

2020

2021

2022

Source:

Moody's / Dealogic

Figure 7. Market Cumulative Issuance - Corporate & Financial Institutions: Euro Denominated

5 24 March 2022

Cross-Sector: Market Data Highlights

MOODY'S ANALYTICS

CROSS-SECTOR

Investment-Grade

High-Yield

Total*

Amount

Amount

Amount

$B

$B

$B

Weekly

31.280

1.000

33.507

Year-to-Date

427.545

52.496

494.796

Investment-Grade

High-Yield

Total*

Amount

Amount

Amount

$B

$B

$B

Weekly

21.572

2.472

26.792

Year-to-Date

207.595

15.423

227.031

* Difference represents issuance with pending ratings.

Source: Moody's/ Dealogic

USD Denominated

Euro Denominated

Figure 8. Issuance: Corporate & Financial Institutions

EMERGING MARKET CREDIT SPREADS

Emerging Market

Duration

A

Baa

Ba

B

A

Baa

Ba

B

>=1 and <3

83

139

222

488

91

157

38

33

>=3 and <5

75

126

285

590

114

121

54

50

>=5 and <7

93

192

302

684

47

97

31

22

>=7

125

232

380

641

130

257

58

29

Emerging Market Sovereign

Duration

A

Baa

Ba

B

A

Baa

Ba

B

>=1 and <3

57

85

80

500

20

41

15

18

>=3 and <5

26

99

211

590

31

37

24

26

>=5 and <7

42

125

268

685

20

37

18

19

>=7

79

201

379

642

84

135

43

28

Emerging Market Corporate

Duration

A

Baa

Ba

B

A

Baa

Ba

B

>=1 and <3

91

156

290

443

71

116

23

15

>=3 and <5

91

147

364

587

83

84

30

24

>=5 and <7

115

212

366

643

27

60

13

3

>=7

171

255

447

598

46

122

15

1

Source: Moody's

Median Spreads

Bond Counts

Median Spreads

Bond Counts

Figure 9. Emerging Market Median OAS

Bond Counts

Median Spreads

6 24 March 2022

Cross-Sector: Market Data Highlights

MOODY'S ANALYTICS

CROSS-SECTOR

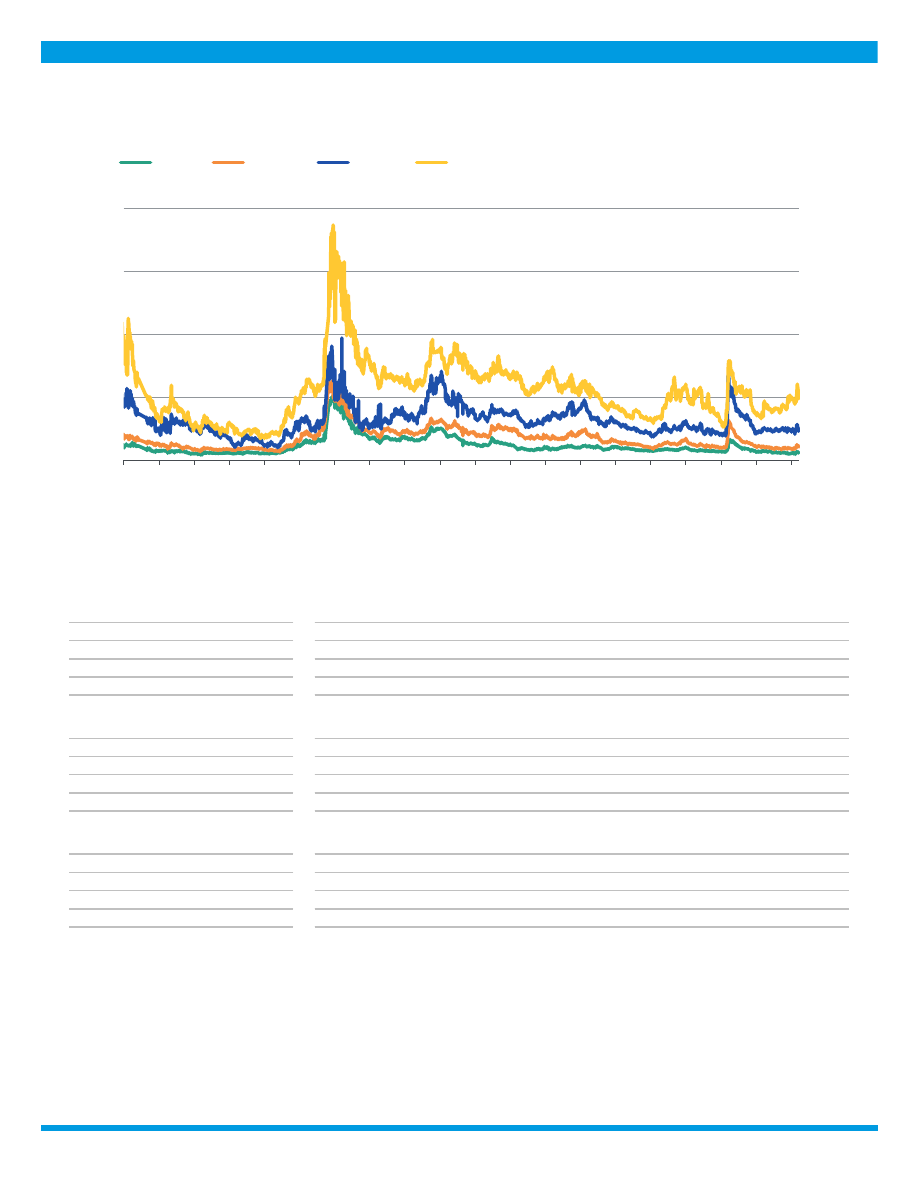

0

600

1,200

1,800

2,400

0

600

1,200

1,800

2,400

2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022

Spread (bp)

Spread (bp)

A

Baa

Ba

B

Source: Moody's

Figure 10: Emerging Markets Median Credit Spreads (3-5 year duration)

MEDIAN CREDIT SPREADS

Duration

Aaa

Aa

A

Baa

Ba

B

Caa

>=1 and <3

33

56

71

128

241

491

505

>=3 and <5

10

44

73

141

250

626

601

>=5 and <7

18

51

85

156

312

404

476

>=7

26

60

103

194

251

-

313

Duration

Aaa

Aa

A

Baa

Ba

B

Caa

>=1 and <3

379

379

662

344

66

11

3

>=3 and <5

276

340

512

292

56

23

4

>=5 and <7

140

149

302

154

29

11

6

>=7

129

321

650

300

19

-

3

Duration

Aaa

Aa

A

Baa

Ba

B

Caa

>=1 and <3

30

95

212

177

36

11

2

>=3 and <5

35

101

189

157

39

20

3

>=5 and <7

28

65

110

91

21

9

6

>=7

32

99

162

121

12

-

2

Source: Moody's

Figure 11. Global Financial Institutions Median Credit Spreads

Median Spreads

Debt Counts

Issuer Counts

7 24 March 2022

Cross-Sector: Market Data Highlights

MOODY'S ANALYTICS

CROSS-SECTOR

Duration

Aaa

Aa

A

Baa

Ba

B

Caa

>=1 and <3

27

62

64

103

237

399

694

>=3 and <5

33

53

65

105

281

453

646

>=5 and <7

41

81

89

137

290

373

566

>=7

87

124

138

187

297

394

735

Duration

Aaa

Aa

A

Baa

Ba

B

Caa

>=1 and <3

22

104

600

900

167

67

24

>=3 and <5

23

117

523

945

219

189

54

>=5 and <7

12

75

437

843

282

250

76

>=7

52

255

1554

2087

197

44

2

Duration

Aaa

Aa

A

Baa

Ba

B

Caa

>=1 and <3

4

48

277

515

113

56

19

>=3 and <5

5

50

285

553

161

170

50

>=5 and <7

5

33

230

499

207

201

70

>=7

5

51

352

618

106

29

2

Source: Moody's

Issuer Counts

Figure 12. Global Corporate Median Credit Spreads

Median Spreads

Debt Counts

MEDIAN 5-YEAR CDS SPREADS

Global Median Spreads by Fine Rating Category

Aaa

Aa1

Aa2

Aa3

A1

A2

A3

Baa1

Baa2

20

27

37

41

47

53

60

69

78

Baa3

Ba1

Ba2

Ba3

B1

B2

B3

Caa

114

167

244

293

353

424

504

889

Global Median Spreads by Broad Rating Category

Aaa

Aa

A

Baa

Ba

B

Caa

27

37

53

78

244

424

709

Global Issuer Counts by Broad Rating Category

Aaa

Aa

A

Baa

Ba

B

Caa

10

48

171

343

87

44

26

Source: Moody's, CMA

Figure 13. Global Median CDS Spreads By Rating Category

8 24 March 2022

Cross-Sector: Market Data Highlights

MOODY'S ANALYTICS

CROSS-SECTOR

Region

Aaa

Aa

A

Baa

Ba

B

Caa

North America

27

36

47

78

243

423

744

Europe

11

39

52

77

191

306

698

Asia Pacific (ex.Japan)

17

36

66

90

158

586

-

Japan

-

-

30

33

56

64

-

Region

Aaa

Aa

A

Baa

Ba

B

Caa

North America

4

19

86

208

55

28

12

Europe

6

29

82

122

23

13

11

Asia Pacific (ex.Japan)

3

18

32

35

5

2

-

Japan

-

-

33

13

3

1

-

Source: Moody's, CMA

Issuer Counts

Figure 14. Median CDS Spreads By Region

Median CDS Spreads

Sector

Aaa

Aa

A

Baa

Ba

B

Caa

Corporates

27

33

41

76

205

344

908

Financials

11

40

58

85

239

421

463

Sovereigns

11

16

60

84

147

851

1986

Banks

-

44

58

96

251

302

418

Sector

Aaa

Aa

A

Baa

Ba

B

Caa

Corporates

4

22

143

317

79

44

21

Financials

9

44

93

74

16

3

5

Banks

-

32

58

29

7

1

4

Sovereigns

9

7

6

13

4

1

1

Source: Moody's, CMA

Issuer Counts

Figure 15. Global Median CDS Spreads by Sector

Median CDS Spreads

9 24 March 2022

Cross-Sector: Market Data Highlights

MOODY'S ANALYTICS

CROSS-SECTOR

Region

Aaa

Aa

A

Baa

Ba

B

Caa

North America

16

46

62

81

252

421

-

Europe

11

39

58

92

147

302

418

Asia Pacific (ex.Japan)

17

35

66

105

113

851

-

Japan

-

-

37

73

-

-

-

Region

Aaa

Aa

A

Baa

Ba

B

Caa

North America

1

8

25

24

5

1

-

Europe

6

23

41

29

4

1

4

Asia Pacific (ex.Japan)

2

13

15

12

3

1

-

Japan

-

-

11

2

-

-

-

Source: Moody's, CMA

Figure 16. Global Financial Institutions Median CDS Spreads by Region

Median CDS Spreads

Issuer Counts

Region

Aaa

Aa

A

Baa

Ba

B

Caa

North America

27

33

43

77

233

424

744

Europe

-

33

43

73

193

307

956

Asia Pacific (ex.Japan)

23

36

66

88

174

321

-

Japan

-

-

29

33

56

64

-

Region

Aaa

Aa

A

Baa

Ba

B

Caa

North America

3

11

61

184

50

27

12

Europe

-

6

41

93

19

12

7

Asia Pacific (ex.Japan)

1

5

17

23

2

1

-

Japan

-

-

22

11

3

1

-

Source: Moody's, CMA

Median CDS Spreads

Issuer Counts

Figure 17. Global Corporates Median CDS Spreads by Region

10 24 March 2022

Cross-Sector: Market Data Highlights

MOODY'S ANALYTICS

CROSS-SECTOR

© 2022 Moody’s Corporation, Moody’s Investors Service, Inc. , Moody’s Analytics, Inc. and/or their licensors and affiliates (collectively, “MOODY’S”). All rights reserved.

CREDIT RATINGS ISSUED BY MOODY'S CREDIT RATINGS AFFILIATES ARE THEIR CURRENT OPINIONS OF THE RELATIVE FUTURE CREDIT RISK OF ENTITIES, CREDIT

COMMITMENTS, OR DEBT OR DEBT-LIKE SECURITIES, AND MATERIALS, PRODUCTS, SERVICES AND INFORMATION PUBLISHED BY MOODY’S (COLLECTIVELY,

“PUBLICATIONS”) MAY INCLUDE SUCH CURRENT OPINIONS. MOODY’S DEFINES CREDIT RISK AS THE RISK THAT AN ENTITY MAY NOT MEET ITS CONTRACTUAL

FINANCIAL OBLIGATIONS AS THEY COME DUE AND ANY ESTIMATED FINANCIAL LOSS IN THE EVENT OF DEFAULT OR IMPAIRMENT. SEE APPLICABLE MOODY’S

RATING SYMBOLS AND DEFINITIONS PUBLICATION FOR INFORMATION ON THE TYPES OF CONTRACTUAL FINANCIAL OBLIGATIONS ADDRESSED BY MOODY’S

CREDIT RATINGS. CREDIT RATINGS DO NOT ADDRESS ANY OTHER RISK, INCLUDING BUT NOT LIMITED TO: LIQUIDITY RISK, MARKET VALUE RISK, OR PRICE

VOLATILITY. CREDIT RATINGS, NON-CREDIT ASSESSMENTS (“ASSESSMENTS”), AND OTHER OPINIONS INCLUDED IN MOODY’S PUBLICATIONS ARE NOT

STATEMENTS OF CURRENT OR HISTORICAL FACT. MOODY’S PUBLICATIONS MAY ALSO INCLUDE QUANTITATIVE MODEL-BASED ESTIMATES OF CREDIT RISK AND

RELATED OPINIONS OR COMMENTARY PUBLISHED BY MOODY’S ANALYTICS, INC. AND/OR ITS AFFILIATES. MOODY’S CREDIT RATINGS, ASSESSMENTS, OTHER

OPINIONS AND PUBLICATIONS DO NOT CONSTITUTE OR PROVIDE INVESTMENT OR FINANCIAL ADVICE, AND MOODY’S CREDIT RATINGS, ASSESSMENTS, OTHER

OPINIONS AND PUBLICATIONS ARE NOT AND DO NOT PROVIDE RECOMMENDATIONS TO PURCHASE, SELL, OR HOLD PARTICULAR SECURITIES. MOODY’S CREDIT

RATINGS, ASSESSMENTS, OTHER OPINIONS AND PUBLICATIONS DO NOT COMMENT ON THE SUITABILITY OF AN INVESTMENT FOR ANY PARTICULAR INVESTOR.

MOODY’S ISSUES ITS CREDIT RATINGS, ASSESSMENTS AND OTHER OPINIONS AND PUBLISHES ITS PUBLICATIONS WITH THE EXPECTATION AND UNDERSTANDING

THAT EACH INVESTOR WILL, WITH DUE CARE, MAKE ITS OWN STUDY AND EVALUATION OF EACH SECURITY THAT IS UNDER CONSIDERATION FOR PURCHASE,

HOLDING, OR SALE.

MOODY’S CREDIT RATINGS, ASSESSMENTS, OTHER OPINIONS, AND PUBLICATIONS ARE NOT INTENDED FOR USE BY RETAIL INVESTORS AND IT WOULD BE RECKLESS

AND INAPPROPRIATE FOR RETAIL INVESTORS TO USE MOODY’S CREDIT RATINGS, ASSESSMENTS, OTHER OPINIONS OR PUBLICATIONS WHEN MAKING AN INVESTMENT

DECISION. IF IN DOUBT YOU SHOULD CONTACT YOUR FINANCIAL OR OTHER PROFESSIONAL ADVISER.

ALL INFORMATION CONTAINED HEREIN IS PROTECTED BY LAW, INCLUDING BUT NOT LIMITED TO, COPYRIGHT LAW, AND NONE OF SUCH INFORMATION MAY BE COPIED

OR OTHERWISE REPRODUCED, REPACKAGED, FURTHER TRANSMITTED, TRANSFERRED, DISSEMINATED, REDISTRIBUTED OR RESOLD, OR STORED FOR SUBSEQUENT USE

FOR ANY SUCH PURPOSE, IN WHOLE OR IN PART, IN ANY FORM OR MANNER OR BY ANY MEANS WHATSOEVER, BY ANY PERSON WITHOUT MOODY’S PRIOR WRITTEN

CONSENT.

MOODY’S CREDIT RATINGS, ASSESSMENTS, OTHER OPINIONS AND PUBLICATIONS ARE NOT INTENDED FOR USE BY ANY PERSON AS A BENCHMARK AS THAT TERM IS

DEFINED FOR REGULATORY PURPOSES AND MUST NOT BE USED IN ANY WAY THAT COULD RESULT IN THEM BEING CONSIDERED A BENCHMARK.

All information contained herein is obtained by MOODY’S from sources believed by it to be accurate and reliable. Because of the possibility of human or mechanical error as well

as other factors, however, all information contained herein is provided “AS IS” without warranty of any kind. MOODY'S adopts all necessary measures so that the information it

uses in assigning a credit rating is of sufficient quality and from sources MOODY'S considers to be reliable including, when appropriate, independent third-party sources. However,

MOODY’S is not an auditor and cannot in every instance independently verify or validate information received in the rating process or in preparing its Publications.

To the extent permitted by law, MOODY’S and its directors, officers, employees, agents, representatives, licensors and suppliers disclaim liability to any person or entity for any

indirect, special, consequential, or incidental losses or damages whatsoever arising from or in connection with the information contained herein or the use of or inability to use any

such information, even if MOODY’S or any of its directors, officers, employees, agents, representatives, licensors or suppliers is advised in advance of the possibility of such losses or

damages, including but not limited to: (a) any loss of present or prospective profits or (b) any loss or damage arising where the relevant financial instrument is not the subject of a

particular credit rating assigned by MOODY’S.

To the extent permitted by law, MOODY’S and its directors, officers, employees, agents, representatives, licensors and suppliers disclaim liability for any direct or compensatory

losses or damages caused to any person or entity, including but not limited to by any negligence (but excluding fraud, willful misconduct or any other type of liability that, for the

avoidance of doubt, by law cannot be excluded) on the part of, or any contingency within or beyond the control of, MOODY’S or any of its directors, officers, employees, agents,

representatives, licensors or suppliers, arising from or in connection with the information contained herein or the use of or inability to use any such information.

NO WARRANTY, EXPRESS OR IMPLIED, AS TO THE ACCURACY, TIMELINESS, COMPLETENESS, MERCHANTABILITY OR FITNESS FOR ANY PARTICULAR PURPOSE OF ANY CREDIT

RATING, ASSESSMENT, OTHER OPINION OR INFORMATION IS GIVEN OR MADE BY MOODY’S IN ANY FORM OR MANNER WHATSOEVER.

Moody’s Investors Service, Inc. , a wholly-owned credit rating agency subsidiary of Moody’s Corporation (“MCO”), hereby discloses that most issuers of debt securities (including

corporate and municipal bonds, debentures, notes and commercial paper) and preferred stock rated by Moody’s Investors Service, Inc. have, prior to assignment of any credit rating,

agreed to pay to Moody’s Investors Service, Inc. for credit ratings opinions and services rendered by it fees ranging from $1,000 to approximately $5,000,000 . MCO and Moody’s

Investors Service also maintain policies and procedures to address the independence of Moody’s Investors Service credit ratings and credit rating processes. Information regarding

certain affiliations that may exist between directors of MCO and rated entities, and between entities who hold credit ratings from Moody’s Investors Service and have also publicly

reported to the SEC an ownership interest in MCO of more than 5%, is posted annually at

under the heading “Investor Relations — Corporate Governance —

Director and Shareholder Affiliation Policy.”

Additional terms for Australia only: Any publication into Australia of this document is pursuant to the Australian Financial Services License of MOODY’S affiliate, Moody’s Investors

Service Pty Limited ABN 61 003 399 657AFSL 336969 and/or Moody’s Analytics Australia Pty Ltd ABN 94 105 136 972 AFSL 383569 (as applicable). This document is intended

to be provided only to “wholesale clients” within the meaning of section 761G of the Corporations Act 2001. By continuing to access this document from within Australia , you

represent to MOODY’S that you are, or are accessing the document as a representative of, a “wholesale client” and that neither you nor the entity you represent will directly or

indirectly disseminate this document or its contents to “retail clients” within the meaning of section 761G of the Corporations Act 2001. MOODY’S credit rating is an opinion as to

the creditworthiness of a debt obligation of the issuer, not on the equity securities of the issuer or any form of security that is available to retail investors.

Additional terms for Japan only: Moody's Japan K.K. (“MJKK”) is a wholly-owned credit rating agency subsidiary of Moody's Group Japan G.K., which is wholly-owned by Moody’s

Overseas Holdings Inc. , a wholly-owned subsidiary of MCO. Moody’s SF Japan K.K. (“MSFJ”) is a wholly-owned credit rating agency subsidiary of MJKK. MSFJ is not a Nationally

Recognized Statistical Rating Organization (“NRSRO”). Therefore, credit ratings assigned by MSFJ are Non-NRSRO Credit Ratings. Non-NRSRO Credit Ratings are assigned by an

entity that is not a NRSRO and, consequently, the rated obligation will not qualify for certain types of treatment under U.S. laws. MJKK and MSFJ are credit rating agencies registered

with the Japan Financial Services Agency and their registration numbers are FSA Commissioner (Ratings) No. 2 and 3 respectively.

MJKK or MSFJ (as applicable) hereby disclose that most issuers of debt securities (including corporate and municipal bonds, debentures, notes and commercial paper) and preferred

stock rated by MJKK or MSFJ (as applicable) have, prior to assignment of any credit rating, agreed to pay to MJKK or MSFJ (as applicable) for credit ratings opinions and services

rendered by it fees ranging from JPY100,000 to approximately JPY550,000,000 .

MJKK and MSFJ also maintain policies and procedures to address Japanese regulatory requirements.

© 2022 Moody’s Corporation, Moody’s Investors Service, Inc. , Moody’s Analytics, Inc. and/or their licensors and affiliates (collectively, “MOODY’S”). All rights reserved.

CREDIT RATINGS ISSUED BY MOODY'S CREDIT RATINGS AFFILIATES ARE THEIR CURRENT OPINIONS OF THE RELATIVE FUTURE CREDIT RISK OF ENTITIES, CREDIT

COMMITMENTS, OR DEBT OR DEBT-LIKE SECURITIES, AND MATERIALS, PRODUCTS, SERVICES AND INFORMATION PUBLISHED BY MOODY’S (COLLECTIVELY,

“PUBLICATIONS”) MAY INCLUDE SUCH CURRENT OPINIONS. MOODY’S DEFINES CREDIT RISK AS THE RISK THAT AN ENTITY MAY NOT MEET ITS CONTRACTUAL

FINANCIAL OBLIGATIONS AS THEY COME DUE AND ANY ESTIMATED FINANCIAL LOSS IN THE EVENT OF DEFAULT OR IMPAIRMENT. SEE APPLICABLE MOODY’S

RATING SYMBOLS AND DEFINITIONS PUBLICATION FOR INFORMATION ON THE TYPES OF CONTRACTUAL FINANCIAL OBLIGATIONS ADDRESSED BY MOODY’S

11 24 March 2022

Cross-Sector: Market Data Highlights

MOODY'S ANALYTICS

CROSS-SECTOR

CREDIT RATINGS. CREDIT RATINGS DO NOT ADDRESS ANY OTHER RISK, INCLUDING BUT NOT LIMITED TO: LIQUIDITY RISK, MARKET VALUE RISK, OR PRICE

VOLATILITY. CREDIT RATINGS, NON-CREDIT ASSESSMENTS (“ASSESSMENTS”), AND OTHER OPINIONS INCLUDED IN MOODY’S PUBLICATIONS ARE NOT

STATEMENTS OF CURRENT OR HISTORICAL FACT. MOODY’S PUBLICATIONS MAY ALSO INCLUDE QUANTITATIVE MODEL-BASED ESTIMATES OF CREDIT RISK AND

RELATED OPINIONS OR COMMENTARY PUBLISHED BY MOODY’S ANALYTICS, INC. AND/OR ITS AFFILIATES. MOODY’S CREDIT RATINGS, ASSESSMENTS, OTHER

OPINIONS AND PUBLICATIONS DO NOT CONSTITUTE OR PROVIDE INVESTMENT OR FINANCIAL ADVICE, AND MOODY’S CREDIT RATINGS, ASSESSMENTS, OTHER

OPINIONS AND PUBLICATIONS ARE NOT AND DO NOT PROVIDE RECOMMENDATIONS TO PURCHASE, SELL, OR HOLD PARTICULAR SECURITIES. MOODY’S CREDIT

RATINGS, ASSESSMENTS, OTHER OPINIONS AND PUBLICATIONS DO NOT COMMENT ON THE SUITABILITY OF AN INVESTMENT FOR ANY PARTICULAR INVESTOR.

MOODY’S ISSUES ITS CREDIT RATINGS, ASSESSMENTS AND OTHER OPINIONS AND PUBLISHES ITS PUBLICATIONS WITH THE EXPECTATION AND UNDERSTANDING

THAT EACH INVESTOR WILL, WITH DUE CARE, MAKE ITS OWN STUDY AND EVALUATION OF EACH SECURITY THAT IS UNDER CONSIDERATION FOR PURCHASE,

HOLDING, OR SALE.

MOODY’S CREDIT RATINGS, ASSESSMENTS, OTHER OPINIONS, AND PUBLICATIONS ARE NOT INTENDED FOR USE BY RETAIL INVESTORS AND IT WOULD BE RECKLESS

AND INAPPROPRIATE FOR RETAIL INVESTORS TO USE MOODY’S CREDIT RATINGS, ASSESSMENTS, OTHER OPINIONS OR PUBLICATIONS WHEN MAKING AN INVESTMENT

DECISION. IF IN DOUBT YOU SHOULD CONTACT YOUR FINANCIAL OR OTHER PROFESSIONAL ADVISER.

ALL INFORMATION CONTAINED HEREIN IS PROTECTED BY LAW, INCLUDING BUT NOT LIMITED TO, COPYRIGHT LAW, AND NONE OF SUCH INFORMATION MAY BE COPIED

OR OTHERWISE REPRODUCED, REPACKAGED, FURTHER TRANSMITTED, TRANSFERRED, DISSEMINATED, REDISTRIBUTED OR RESOLD, OR STORED FOR SUBSEQUENT USE

FOR ANY SUCH PURPOSE, IN WHOLE OR IN PART, IN ANY FORM OR MANNER OR BY ANY MEANS WHATSOEVER, BY ANY PERSON WITHOUT MOODY’S PRIOR WRITTEN

CONSENT.

MOODY’S CREDIT RATINGS, ASSESSMENTS, OTHER OPINIONS AND PUBLICATIONS ARE NOT INTENDED FOR USE BY ANY PERSON AS A BENCHMARK AS THAT TERM IS

DEFINED FOR REGULATORY PURPOSES AND MUST NOT BE USED IN ANY WAY THAT COULD RESULT IN THEM BEING CONSIDERED A BENCHMARK.

All information contained herein is obtained by MOODY’S from sources believed by it to be accurate and reliable. Because of the possibility of human or mechanical error as well

as other factors, however, all information contained herein is provided “AS IS” without warranty of any kind. MOODY'S adopts all necessary measures so that the information it

uses in assigning a credit rating is of sufficient quality and from sources MOODY'S considers to be reliable including, when appropriate, independent third-party sources. However,

MOODY’S is not an auditor and cannot in every instance independently verify or validate information received in the rating process or in preparing its Publications.

To the extent permitted by law, MOODY’S and its directors, officers, employees, agents, representatives, licensors and suppliers disclaim liability to any person or entity for any

indirect, special, consequential, or incidental losses or damages whatsoever arising from or in connection with the information contained herein or the use of or inability to use any

such information, even if MOODY’S or any of its directors, officers, employees, agents, representatives, licensors or suppliers is advised in advance of the possibility of such losses or

damages, including but not limited to: (a) any loss of present or prospective profits or (b) any loss or damage arising where the relevant financial instrument is not the subject of a

particular credit rating assigned by MOODY’S.

To the extent permitted by law, MOODY’S and its directors, officers, employees, agents, representatives, licensors and suppliers disclaim liability for any direct or compensatory

losses or damages caused to any person or entity, including but not limited to by any negligence (but excluding fraud, willful misconduct or any other type of liability that, for the

avoidance of doubt, by law cannot be excluded) on the part of, or any contingency within or beyond the control of, MOODY’S or any of its directors, officers, employees, agents,

representatives, licensors or suppliers, arising from or in connection with the information contained herein or the use of or inability to use any such information.

NO WARRANTY, EXPRESS OR IMPLIED, AS TO THE ACCURACY, TIMELINESS, COMPLETENESS, MERCHANTABILITY OR FITNESS FOR ANY PARTICULAR PURPOSE OF ANY CREDIT

RATING, ASSESSMENT, OTHER OPINION OR INFORMATION IS GIVEN OR MADE BY MOODY’S IN ANY FORM OR MANNER WHATSOEVER.

Moody’s Investors Service, Inc. , a wholly-owned credit rating agency subsidiary of Moody’s Corporation (“MCO”), hereby discloses that most issuers of debt securities (including

corporate and municipal bonds, debentures, notes and commercial paper) and preferred stock rated by Moody’s Investors Service, Inc. have, prior to assignment of any credit rating,

agreed to pay to Moody’s Investors Service, Inc. for credit ratings opinions and services rendered by it fees ranging from $1,000 to approximately $5,000,000 . MCO and Moody’s

Investors Service also maintain policies and procedures to address the independence of Moody’s Investors Service credit ratings and credit rating processes. Information regarding

certain affiliations that may exist between directors of MCO and rated entities, and between entities who hold credit ratings from Moody’s Investors Service and have also publicly

reported to the SEC an ownership interest in MCO of more than 5%, is posted annually at

under the heading “Investor Relations — Corporate Governance —

Director and Shareholder Affiliation Policy.”

Additional terms for Australia only: Any publication into Australia of this document is pursuant to the Australian Financial Services License of MOODY’S affiliate, Moody’s Investors

Service Pty Limited ABN 61 003 399 657AFSL 336969 and/or Moody’s Analytics Australia Pty Ltd ABN 94 105 136 972 AFSL 383569 (as applicable). This document is intended

to be provided only to “wholesale clients” within the meaning of section 761G of the Corporations Act 2001. By continuing to access this document from within Australia , you

represent to MOODY’S that you are, or are accessing the document as a representative of, a “wholesale client” and that neither you nor the entity you represent will directly or

indirectly disseminate this document or its contents to “retail clients” within the meaning of section 761G of the Corporations Act 2001. MOODY’S credit rating is an opinion as to

the creditworthiness of a debt obligation of the issuer, not on the equity securities of the issuer or any form of security that is available to retail investors.

Additional terms for Japan only: Moody's Japan K.K. (“MJKK”) is a wholly-owned credit rating agency subsidiary of Moody's Group Japan G.K., which is wholly-owned by Moody’s

Overseas Holdings Inc. , a wholly-owned subsidiary of MCO. Moody’s SF Japan K.K. (“MSFJ”) is a wholly-owned credit rating agency subsidiary of MJKK. MSFJ is not a Nationally

Recognized Statistical Rating Organization (“NRSRO”). Therefore, credit ratings assigned by MSFJ are Non-NRSRO Credit Ratings. Non-NRSRO Credit Ratings are assigned by an

entity that is not a NRSRO and, consequently, the rated obligation will not qualify for certain types of treatment under U.S. laws. MJKK and MSFJ are credit rating agencies registered

with the Japan Financial Services Agency and their registration numbers are FSA Commissioner (Ratings) No. 2 and 3 respectively.

MJKK or MSFJ (as applicable) hereby disclose that most issuers of debt securities (including corporate and municipal bonds, debentures, notes and commercial paper) and preferred

stock rated by MJKK or MSFJ (as applicable) have, prior to assignment of any credit rating, agreed to pay to MJKK or MSFJ (as applicable) for credit ratings opinions and services

rendered by it fees ranging from JPY100,000 to approximately JPY550,000,000 .

MJKK and MSFJ also maintain policies and procedures to address Japanese regulatory requirements.

For Publications Issued by Moody’s Capital Markets Research, Inc. only:

The statements contained in this research report are based solely upon the opinions of Moody’s Capital Markets Research, Inc. and the data and information available to the authors

at the time of publication of this report. There is no assurance that any predicted results will actually occur. Past performance is no guarantee of future results.

The analysis in this report has not been made available to any issuer prior to publication.

When making an investment decision, investors should use additional sources of information and consult with their investment advisor. Investing in securities involves certain risks

including possible fluctuations in investment return and loss of principal. Investing in bonds presents additional risks, including changes in interest rates and credit risk.

Moody's Capital Markets Research, Inc. , is a subsidiary of MCO. Please note that Moody’s Analytics, Inc. , an affiliate of Moody’s Capital Markets Research, Inc. and a subsidiary of

MCO, provides a wide range of research and analytical products and services to corporations and participants in the financial markets. Customers of Moody’s Analytics, Inc. may

include companies mentioned in this report. Please be advised that a conflict may exist and that any investment decisions you make are your own responsibility. The Moody’s

Analytics logo is used on certain Moody’s Capital Markets Research, Inc. products for marketing purposes only. Moody’s Analytics, Inc. is a separate company from Moody’s Capital

Markets Research, Inc.

12 24 March 2022

Cross-Sector: Market Data Highlights

MOODY'S ANALYTICS

CROSS-SECTOR

REPORT NUMBER

1323357

13 24 March 2022

Cross-Sector: Market Data Highlights