Hecla Mining (HL) Q2 Earnings Beat Estimates, Revenues Lag

Hecla Mining’s HL second-quarter 2022 adjusted earnings per share of 4 cents beating the Zacks Consensus Estimate of 2 cents by a margin of 100%. The company reported earnings of 6 cents per share in the second quarter of 2021. Earnings were impacted by lower realized prices for all metals.

Including one-time items, HL reported a loss of 3 cents per share against earnings of 1 cent per share in the last-year quarter.

The company’s revenues declined 12% year over year to $191 million in the quarter under review. The top-line figure lagged the Zacks Consensus Estimate of $194 million.

Total cost of sales dipped 1.3% year on year to $154 million in the quarter. Gross profit plunged 40% to $37.3 million. Gross margin in the second quarter of 2022 was 19.5%, an 890 basis point contraction from the year-ago quarter. Adjusted EBITDA was $70.5 million, down from $84.5 million in the second quarter of 2021.

Hecla Mining Company Price, Consensus and EPS Surprise

Hecla Mining Company price-consensus-eps-surprise-chart | Hecla Mining Company Quote

Realized silver price was $20.68 per ounce in the quarter. The company reported cash costs per silver equivalent ounce and all-in sustaining costs (AISC) per silver ounce of $8.55 in the quarter.

Production Numbers

Hecla Mining reported silver production of 3.6 million ounces in the second quarter of 2022, up 10% on a sequential basis, primarily driven by solid performance at the Lucky Friday mine that surpassed the 1 million ounce mark. Compared with the second quarter of 2021, production was up 3%. Apart from Lucky Friday, the company’s other two operating mines — Casa Berardi and Greens Creek — delivered solid performances as well.

Gold production was up 10% to 45,718 ounces compared with the first quarter of 2022, aided by improved performance at the Casa Berardi mine. However, compared with the last year’s comparable quarter, gold production was down 23%. Lead production was 13,331 tons, up 23% on a sequential basis and 16% year over year, backed by higher production at Lucky Friday. Zinc output went up 12% to 16,766 tons from the first quarter of 2022. Compared with the last year’s quarter, zinc production went down 3%.

Financial Position

Hecla Mining ended second-quarter 2022 with $198 million of cash in hand, up from the $210 million held at the end of 2021. Cash flow from operating activities was $78 million in the first six months period of 2022 compared $124 million in the prior-year comparable period.

Guidance

HL expects to produce 12.9-13.5 million ounces of silver in 2022. Gold production is expected in the range of 165,000 ounces to 175,000 ounces.

Other Updates

Hecla Mining recently announced that it would acquire all of the remaining outstanding common shares in Alexco Resource Corp. AXU. The deal is expected to close next month. Alexco is a Canadian primary silver company that owns and operates the majority of the historic Keno Hill Silver District in Canada's Yukon Territory — one of the highest-grade silver districts in the world.

With this buyout, Hecla gains access to a fully permitted property in a premier mining jurisdiction with infrastructure that includes a 400-ton per day mill, on-site camp facility, all-season highway access, and connection to the hydropower grid. It adds to Hecla's significant silver reserves. HL is currently the largest primary silver producer in the United States and the third-largest in the world. Following this buyout, there's a possibility of it becoming Canada's largest silver producer as well.

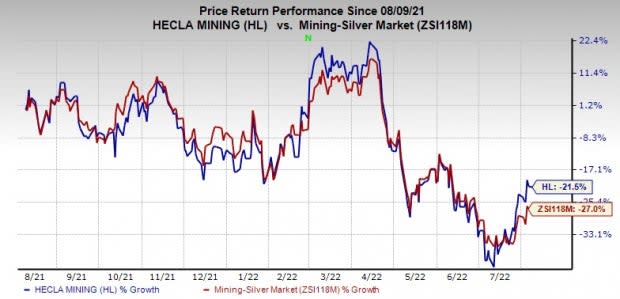

Price Performance

Image Source: Zacks Investment Research

Shares of Hecla Mining have fallen 21.5% in the past year compared with the industry's decline of 27%.

Zacks Rank & Stocks to Consider

Hecla Mining currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks worth considering in the basic materials space include Cabot Corporation CBT and Ashland Global Holdings Inc. ASH.

Cabot, currently sporting a Zacks Rank #1 (Strong Buy), has an expected earnings growth rate of 22.5% for the current fiscal year. The Zacks Consensus Estimate for CBT's earnings for the current fiscal has been revised 0.8% upward in the past 60 days. You can see the complete list of today’s Zacks #1 Rank stocks here.

Cabot’s earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, the average being 16.2%. CBT has gained around 35% over a year.

Ashland, currently carrying a Zacks Rank #2 (Buy), has a projected earnings growth rate of 50.9% for fiscal 2022. The Zacks Consensus Estimate for ASH’s fiscal 2022 earnings has been revised 10.5% upward in the past 60 days.

ASH’s earnings beat the Zacks Consensus Estimate in three of the trailing four quarters and missed once. It has a trailing four-quarter earnings surprise of roughly 1.82%, on average. ASH shares are up around 22.1% in a year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ashland Inc. (ASH) : Free Stock Analysis Report

Cabot Corporation (CBT) : Free Stock Analysis Report

Hecla Mining Company (HL) : Free Stock Analysis Report

Alexco Resource Corp (AXU) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research