Reinsurance Group (RGA) Expands Capacity With Launch of Ruby Re

Reinsurance Group of America, Incorporated RGA recently announced the launch of a third-party life reinsurance sidecar, Ruby Reinsurance Company (“Ruby Re”), domiciled in Missouri. It has completed the first round of funding and secured capital commitments in the form of equity from major investors like Sammons Financial Group, Golub Capital, and Hudson Structured Capital Management Ltd.

Ruby Re will be established as a non-market-facing sidecar, which would reinsure the portfolio of the sponsor, RGA, through a quota share arrangement and not deal with clients directly. RGA will retrocede $2.5 billion of current liabilities to Ruby Re and transfer a portion of premiums to compensate for the risk taken. This will reduce the dollar amount of risk shown in RGA’s accounts.

The aim of a reinsurance sidecar is to spread the underwriting risk assumed by its sponsor and provide additional reinsurance capacity when the market is constrained. RGA could have reinsured itself by ceding premiums to a reinsurance company. However, another alternative is to form a financial entity and solicit private investment at comparatively lower costs. Investors in the sidecar gain from premiums earned and the ability to enter the reinsurance market for a limited time in favorable market conditions.

This move bodes well for RGA as it expands its capacity to reinsure more risks and gives the opportunity to earn a stable fee income for underwriting, client servicing and administration for the sidecar. Moreover, RGA might earn a profit commission and a ceding commission in case underwritten risks turn out to be profitable. As more investors enter the reinsurance market through investments in sidecars, reinsurers will be compelled to offer more competitive rates, aiding companies like RGA in need of reinsurance.

RGA stands to benefit from the growing U.S. asset-intensive business through Ruby Re. The U.S. asset-intensive business is expected to grow from improving transaction and fees, favorable longevity experience and equity markets as well as higher variable investment income from commercial loan prepayments.

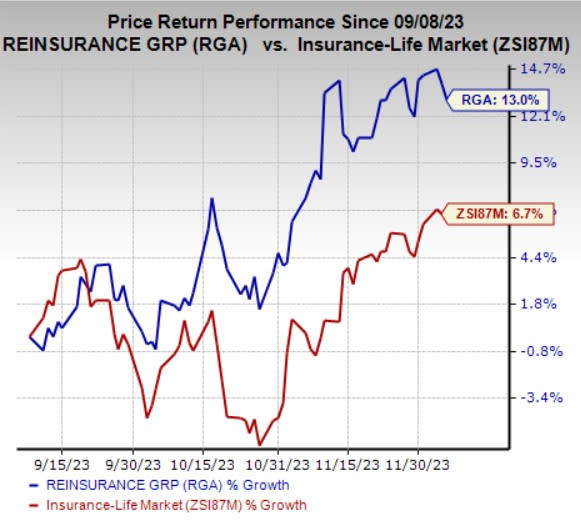

Zacks Rank & Price Performance

Reinsurance Group currently carries a Zacks Rank #2 (Buy). Shares of the company have gained 13% in the past three months, outperforming the industry’s growth of 6.7%.

Image Source: Zacks Investment Research

Other Key Picks

Some other top-ranked stocks from the broader Finance space are Primerica, Inc. PRI, American Equity Investment Life Holding Company AEL and Aflac Incorporated AFL. Each stock presently carries a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The consensus mark for Primerica’s current-year earnings indicates a 39.9% year-over-year increase. Furthermore, the consensus estimate for PRI’s revenues in 2023 suggests 3.2% year-over-year growth.

The Zacks Consensus Estimate for American Equity’s current-year earnings has improved 12.1% in the past 30 days. The consensus mark for AEL’s current-year earnings indicates 97.3% year-over-year growth.

The consensus mark for Aflac’s current-year earnings indicates an 18.2% year-over-year increase. The Zacks Consensus Estimate for AFL’s current-year earnings has improved 1.1% in the past 30 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Aflac Incorporated (AFL) : Free Stock Analysis Report

American Equity Investment Life Holding Company (AEL) : Free Stock Analysis Report

Reinsurance Group of America, Incorporated (RGA) : Free Stock Analysis Report

Primerica, Inc. (PRI) : Free Stock Analysis Report