Solus Alternative Asset Management LP Reduces Stake in Bristow Group Inc

In a recent transaction, Solus Alternative Asset Management LP (Trades, Portfolio), a prominent investment firm, has reduced its holdings in Bristow Group Inc (NYSE:VTOL). This article will delve into the details of the transaction, provide an overview of the guru and the traded company, and analyze the potential implications of this move on the stock market.

Details of the Transaction

On August 7, 2023, Solus Alternative Asset Management LP (Trades, Portfolio) reduced its stake in Bristow Group Inc by 20,534 shares, representing a change of -0.56%. The shares were traded at a price of $30.92 each. Following this transaction, the firm holds a total of 3,655,131 shares in Bristow Group Inc, accounting for 44.99% of its portfolio and 12.97% of the company's total shares. The transaction had a -0.25% impact on the guru's portfolio.

Profile of Solus Alternative Asset Management LP (Trades, Portfolio)

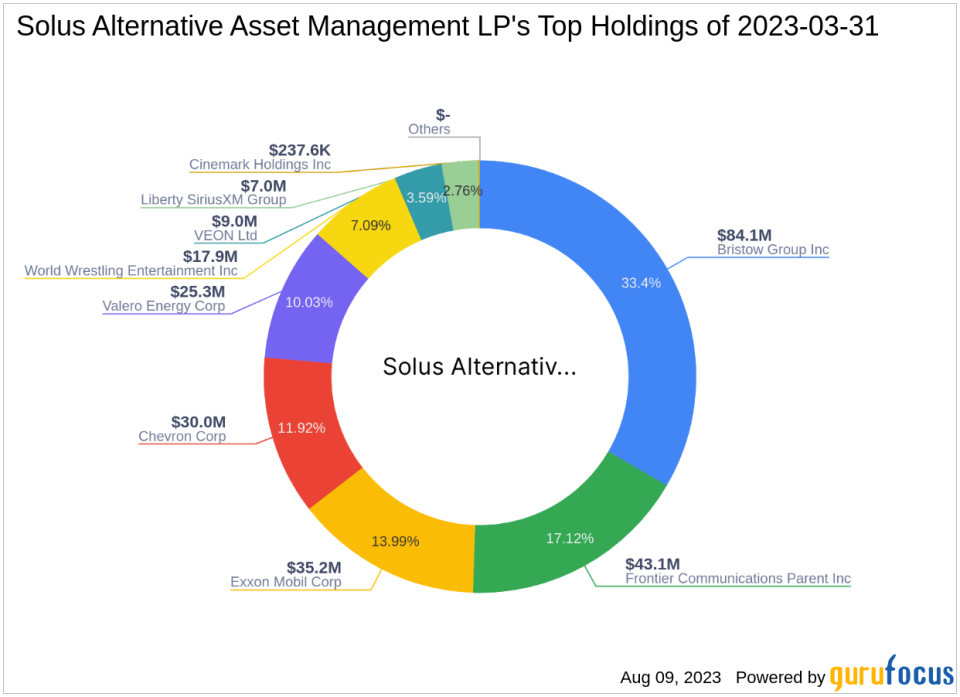

Solus Alternative Asset Management LP (Trades, Portfolio) is a renowned investment firm based in Summit, New Jersey. The firm's portfolio consists of 9 stocks, with a total equity of $252 million. Its top holdings include Chevron Corp (NYSE:CVX), Valero Energy Corp (NYSE:VLO), Exxon Mobil Corp (NYSE:XOM), Bristow Group Inc (NYSE:VTOL), and Frontier Communications Parent Inc (NASDAQ:FYBR). The firm's investments are primarily concentrated in the Energy and Communication Services sectors.

Overview of Bristow Group Inc

Bristow Group Inc, symbolized as VTOL, is a leading provider of vertical flight solutions. The company offers aviation services to a broad base of major integrated, national, and independent energy companies. It also provides commercial search and rescue services in multiple countries and public sector SAR services in the United Kingdom on behalf of the Maritime & Coastguard Agency (MCA). The company's market capitalization stands at $854.018 million, and its stock is currently priced at $30.31. According to GuruFocus, the stock is fairly valued with a GF Value of $31.79.

Analysis of Bristow Group Inc's Stock Performance

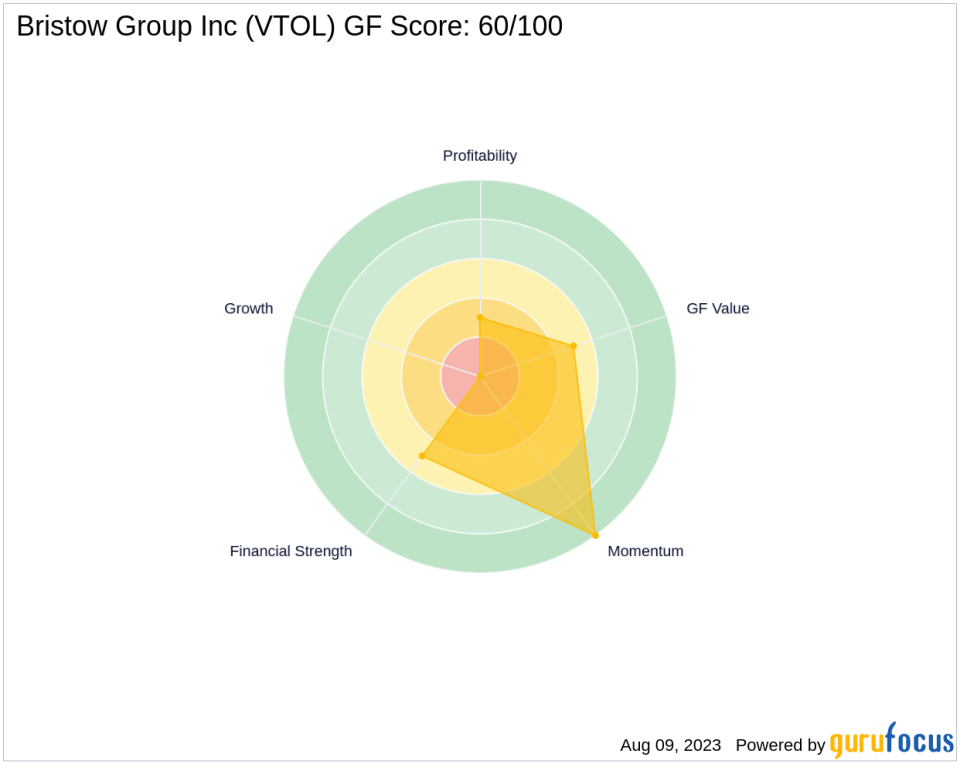

Bristow Group Inc's stock performance is evaluated using various metrics. The company's GF Score is 60/100, indicating a moderate future performance potential. Its Financial Strength is ranked 5/10, while its Profitability Rank is 3/10. The company's Growth Rank is not applicable due to insufficient data. The company's Piotroski F-Score is 6, and its Altman Z score is 1.50, indicating a moderate risk of financial distress.

Industry Analysis

Bristow Group Inc operates in the Oil & Gas industry. The company's performance is compared with industry averages and trends to provide a comprehensive view of its standing in the market. The company's interest coverage is 0.78, ranking 737 in the industry. Its ROE and ROA are 0.81 and 0.35, respectively, with ranks of 670 and 674.

Donald Smith & Co: The Largest Guru Holding Bristow Group Inc

Donald Smith & Co is the guru with the most shares in Bristow Group Inc. The investment by Donald Smith & Co in Bristow Group Inc has a significant impact on the company's stock.

Conclusion

In conclusion, Solus Alternative Asset Management LP (Trades, Portfolio)'s recent transaction in Bristow Group Inc is a significant move that could influence the stock's performance and the firm's portfolio. As of August 10, 2023, all data and rankings are accurate and based on the provided relative data. Investors and market watchers should keep a close eye on these developments to make informed decisions.

This article first appeared on GuruFocus.