Merck's (MRK) Meets Goal in Muscle-Invasive Bladder Cancer Study

Merck MRK announced results from the ongoing late-stage AMBASSADOR/KEYNOTE-123 study on Keytruda as an adjuvant treatment of patients with localized muscle-invasive urothelial carcinoma (“MIUC”) and locally advanced urothelial carcinoma (“UC”).

Data from the study demonstrated that treatment with Keytruda resulted in a statistically significant and clinically meaningful improvement in the primary endpoint of disease-free survival (“DFS”) compared to observation. The safety profile of the drug was consistent with previously-reported studies.

Management will continue to evaluate the study for its other dual primary endpoint of overall survival (“OS”).

Per the American Cancer Society, UC is the most common type of bladder cancer. Management estimates that around half of bladder cancer patients who undergo surgery experience disease recurrence within a year of surgery. By adding Keytruda as an adjuvant therapy, patients with localized MIUC or locally-advanced UC can have a new treatment option as the drug has the potential to prevent recurrence after surgery.

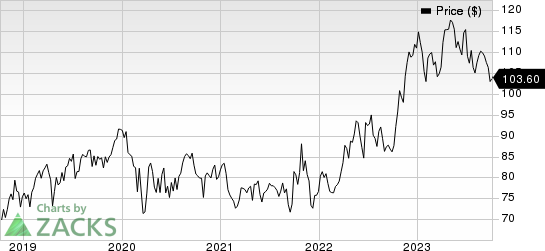

Merck’s shares have lost 6.6% year to date against the industry’s 3.8% growth.

Image Source: Zacks Investment Research

Keytruda is approved by the FDA for three indications in UC. In April, Keytruda plus Seagen’s SGEN Padcev (enfortumab vedotin) was approved under the accelerated pathway as a first-line treatment for patients with locally advanced or metastatic UC who are ineligible for cisplatin-containing chemotherapy.

Last month, Merck and Seagen reported positive top-line results from a late-stage study (KEYNOTE-A39/EV-302) on the Keytruda-Padcev combination to treat adult patients with previously untreated locally advanced or metastatic urothelial cancer (la/mUC). Conducted in partnership with Seagen, the study achieved its co-primary endpoints of OS and progression-free survival (“PFS”). The Merck/Seagen conducted study intends to serve as a confirmatory study seeking to convert the accelerated approval to a full one.

Keytruda, an anti-PD-1 therapy, is Merck’s blockbuster oncology drug and is approved for several types of cancer, accounting alone for around 40% of MRK’s pharmaceutical sales. Keytruda is presently approved to treat seven indications in earlier-stage cancers in the United States. Merck’s Keytruda is continuously growing and expanding into new indications and markets globally.

Keytruda, the key revenue generator for Merck, is already approved for treating many cancers globally. In the first half of 2023, Merck recorded $12.1 billion in sales from Keytruda, up 20% year over year. Drug sales are gaining from continued strong momentum in metastatic indications and rapid uptake across recent earlier-stage launches. Keytruda is continuously growing and expanding into new indications and markets globally.

Merck is evaluating Keytruda across many indications that are progressing well. Keytruda is being studied for more than 30 types of cancer indications in more than 1600 studies, including combination studies. If approved, label expansions for new cancer indications can boost sales.

Merck & Co., Inc. Price

Merck & Co., Inc. price | Merck & Co., Inc. Quote

Zacks Rank & Stocks to Consider

Merck currently carries a Zacks Rank #3 (Hold). A couple of better-ranked stocks in the overall healthcare sector include Annovis Bio ANVS and Vaxxinity VAXX, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 60 days, estimates for Annovis Bio’s 2023 loss per share have narrowed from $4.89 to $4.38. During the same period, the loss estimates per share for 2024 have improved from $3.18 to $2.77. Year to date, shares of Annovis have lost 32.8%.

Earnings of Annovis Bio beat estimates in three of the last four quarters while missing the mark on one occasion, witnessing an earnings surprise of 13.40% on average. In the last reported quarter, Annovis’ earnings beat estimates by 6.14%.

In the past 60 days, estimates for Vaxxinity’s 2023 earnings per share narrowed from 69 cents to 58 cents. During the same period, the loss estimates per share for 2024 have improved from 70 cents to 54 cents. Year to date, shares of Vaxxinity have lost 21.1%.

Earnings of Vaxxinity beat estimates in three of the trailing four quarters while meeting the mark on one occasion, witnessing an average earnings surprise of 10.94%. In the last reported quarter, Vaxxinity’s earnings beat estimates by 31.25%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Merck & Co., Inc. (MRK) : Free Stock Analysis Report

Seagen Inc. (SGEN) : Free Stock Analysis Report

Annovis Bio, Inc. (ANVS) : Free Stock Analysis Report

Vaxxinity, Inc. (VAXX) : Free Stock Analysis Report