Insider Sell Alert: Director N Simmons Sells 2,000 Shares of Kforce Inc (KFRC)

In the realm of stock market movements, insider trading activity is often a significant indicator that investors keep a close eye on. Recently, Director N Simmons made a notable move by selling 2,000 shares of Kforce Inc (NASDAQ:KFRC) on December 4, 2023. This transaction has caught the attention of market watchers and raises questions about the implications for Kforce Inc and its stock valuation.

Who is N Simmons of Kforce Inc?

N Simmons serves as a Director at Kforce Inc, a prominent staffing services and solutions firm specializing in the technology and finance sectors. Directors like Simmons are privy to the most current and intimate knowledge of a company's operations, financial health, and strategic direction. Therefore, their trading activities are closely monitored for insights into their confidence in the company's future performance.

Kforce Inc's Business Description

Kforce Inc is a professional staffing firm that provides strategic partnership in the areas of Technology and Finance & Accounting services. The company engages in both temporary and permanent staffing solutions, aiming to connect professionals with the right opportunities. Kforce prides itself on its deep understanding of industry trends and its ability to match skilled individuals with the evolving needs of its client base.

Analysis of Insider Buy/Sell and Relationship with Stock Price

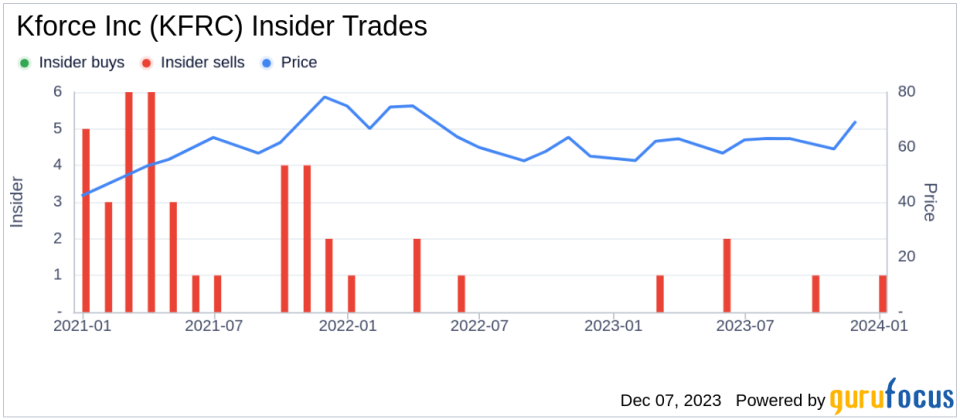

The recent sale by N Simmons is part of a broader pattern of insider activity at Kforce Inc. Over the past year, there have been zero insider buys and five insider sells, indicating a trend where insiders are choosing to liquidate shares rather than acquire more. This could be interpreted in several ways: insiders might believe the stock is currently overvalued, or they could simply be diversifying their personal portfolios.

When analyzing the relationship between insider trading and stock price, it's important to consider the context of each transaction. Insider selling does not always signal a lack of confidence in the company. It could be related to personal financial planning or other non-company-specific reasons. However, consistent selling by multiple insiders over time might suggest that those with the most knowledge of the company see less upside potential.

Valuation and Market Response

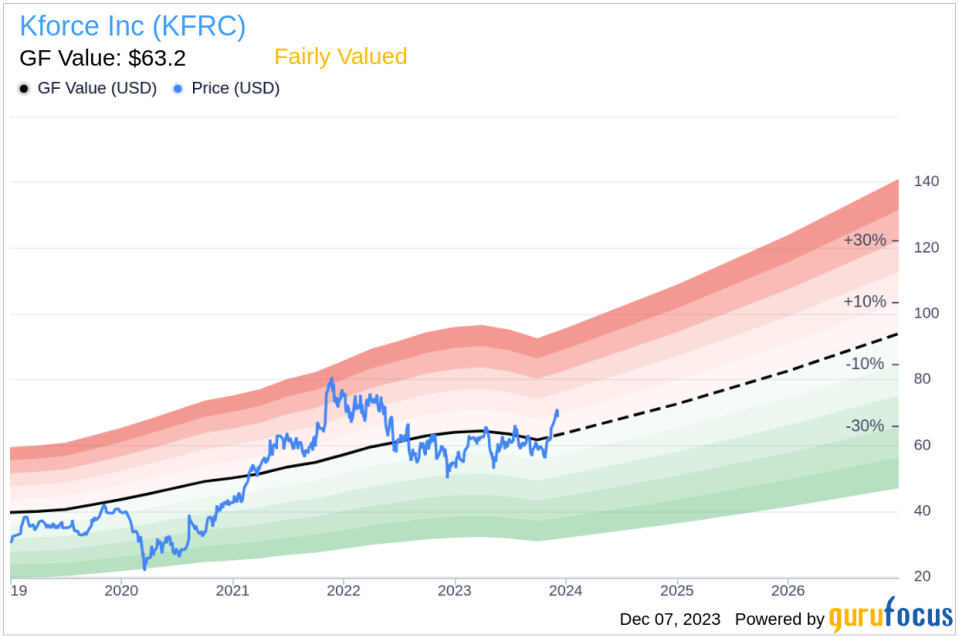

On the day of the insider's recent sale, Kforce Inc shares were trading at $69, giving the company a market cap of $1.356 billion. The price-earnings ratio stands at 25.83, which is above both the industry median of 17.33 and the company's historical median. This higher valuation could be one of the factors influencing the insider's decision to sell shares.With a price of $69 and a GuruFocus Value of $63.20, Kforce Inc has a price-to-GF-Value ratio of 1.09, indicating that the stock is Fairly Valued based on its GF Value. The GF Value is a proprietary intrinsic value estimate from GuruFocus, which takes into account historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates.

The GF Value serves as a benchmark for investors, suggesting that while Kforce Inc is not significantly overvalued, there may not be a substantial margin of safety for new investors at the current price level. This aligns with the insider's decision to sell shares, as they may perceive limited growth potential at these valuation levels.

Conclusion

The sale of 2,000 shares by Director N Simmons is a transaction that warrants attention from Kforce Inc investors and potential investors. While the company is currently deemed Fairly Valued, the insider's sell-off, coupled with a higher than average price-earnings ratio, could suggest that there are better value opportunities elsewhere in the market. As always, insider trading is just one piece of the puzzle, and investors should consider a wide array of factors, including company performance, industry trends, and broader market conditions, before making investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.