Apple's (NASDAQ:AAPL) Price is Still Running Ahead of Current Forecasts

This article originally appeared on Simply Wall St News.

Apple Inc. ( NASDAQ:AAPL ) recently crossed the $3 trillion market capitalization mark which put the stock back in the spotlight heading into 2022. Now that the share price has pulled back 8% from the highs, is it offering investors an opportunity? We decided to have a look at Apple’s outlook and value based on the most recent financial data to see if there may still be an opportunity at the current price.

See our latest analysis for Apple

Is Apple still cheap?

Apple is currently trading on a price to earnings (P/E) ratio of 29.7x. This is well ahead of the average US stock which trades on a P/E ratio of 17x, but it isn't necessarily excessive for a company of Apple’s caliber. However, for a company to trade at a premium to the market like this, one would assume it’s expected to deliver above average earnings growth going forward.

When we estimate the fair value for Apple using analyst forecasts , we come to a share price of $112.79, which is 34% lower than the current price. This implies the stock may be overvalued, however this estimate is only as good as the estimated cash flows that go into it. And this is where there seems to be a discrepancy between the market’s outlook and analyst forecasts.

Can we expect growth from Apple?

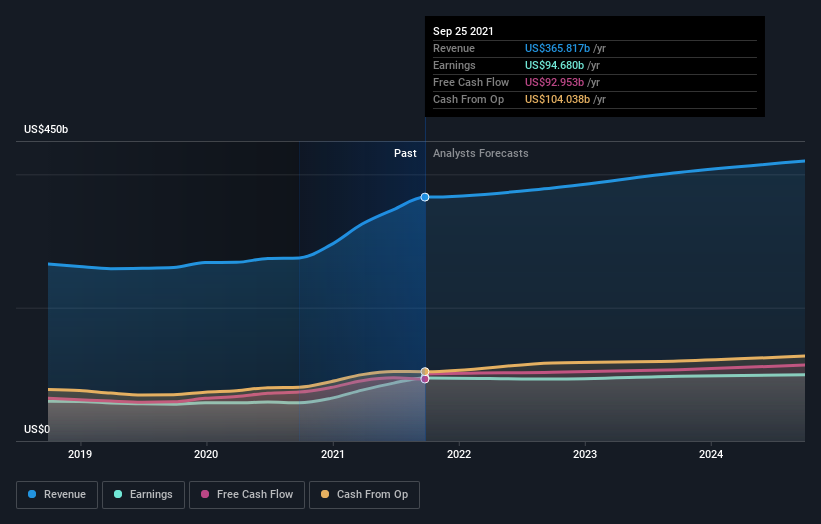

The chart below clearly illustrates that analysts are expecting Apple’s earnings growth to slow down over the next year or two. After delivering earnings growth of 65% in the last year, growth is expected to slow dramatically over the next three years. In fact, some analysts even believe earnings will be lower as far out as September 2023.

There are at least two catalysts that could dramatically change the outlook in the next 12 months. The first is the expected launch of a VR headset later this year, as well as other products in the virtual and augmented reality space. The second is a larger contribution to the bottom line from Apple’s subscriptions based services.

Both of these business segments will undoubtedly contribute to earnings growth in the future - but the timing and magnitude is uncertain. So it isn’t entirely surprising that investors may be more optimistic than analysts.

Of course iPhone sales or product announcements could also act as a catalyst - but could also lead to disappointment as some analysts are suggesting.

What this means for you:

Apple’s valuation has run ahead of analyst expectations, even when we account for recent price weakness. This doesn’t mean the share price is due for a correction, but it may mean the company will need to deliver enough in 2022 to keep the optimism going. This could come in the form of raised guidance, but it could also come in the form of product announcements and launches. If the company fails to deliver, the valuation probably would be a risk.

To keep track of the latest forecasts for Apple, as well as other insights about the company, have a look at our free analysis of Apple.

If you are no longer interested in Apple, you can use our free platform to see our list of over 50 other stocks with a high growth potential.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.