There's Reason For Concern Over Donnelley Financial Solutions, Inc.'s (NYSE:DFIN) Price

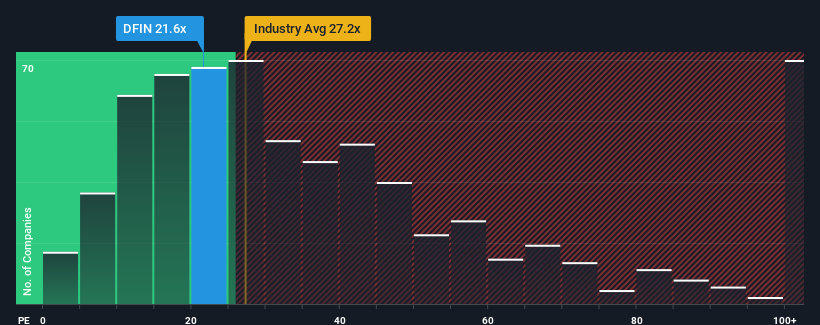

When close to half the companies in the United States have price-to-earnings ratios (or "P/E's") below 16x, you may consider Donnelley Financial Solutions, Inc. (NYSE:DFIN) as a stock to potentially avoid with its 21.6x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

With earnings that are retreating more than the market's of late, Donnelley Financial Solutions has been very sluggish. One possibility is that the P/E is high because investors think the company will turn things around completely and accelerate past most others in the market. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Donnelley Financial Solutions

Want the full picture on analyst estimates for the company? Then our free report on Donnelley Financial Solutions will help you uncover what's on the horizon.

How Is Donnelley Financial Solutions' Growth Trending?

There's an inherent assumption that a company should outperform the market for P/E ratios like Donnelley Financial Solutions' to be considered reasonable.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 24%. However, a few very strong years before that means that it was still able to grow EPS by an impressive 471% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Shifting to the future, estimates from the four analysts covering the company suggest earnings should grow by 6.8% over the next year. With the market predicted to deliver 10% growth , the company is positioned for a weaker earnings result.

With this information, we find it concerning that Donnelley Financial Solutions is trading at a P/E higher than the market. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. There's a good chance these shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

The Key Takeaway

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Donnelley Financial Solutions currently trades on a much higher than expected P/E since its forecast growth is lower than the wider market. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the high P/E lower. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

It is also worth noting that we have found 2 warning signs for Donnelley Financial Solutions that you need to take into consideration.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.